Kount (fraud) integration

Integrate with Kount for advanced fraud protection, ensuring safer transactions and a more secure customer experience.

Overview

Required plan

This feature may not be included in the Starter or Pro plans. If you are interested, please contact Recurly Sales to discuss upgrade options.

Limitations

- Risk inquiries are only performed on new card verifications (sign-ups and billing info updates).

- Existing accounts with a credit or debit card on file will not undergo risk inquiries unless they update their billing information.

Definition

Kount is a leading fraud management platform that specializes in ensuring secure online transactions. Through its integration with Recurly, businesses can benefit from enhanced fraud detection and prevention mechanisms, ensuring a safer and more seamless transaction experience for their customers.

Recurly recognizes the importance of safeguarding businesses from potential threats. In our commitment to support and protect our customers, we've partnered with Kount, a frontrunner in fraud management. This collaboration equips you with top-tier fraud prevention capabilities right within your Recurly platform.

Key benefits

- Reduced fraudulent orders: Minimize the risk of accepting deceptive orders to safeguard your business.

- Decreased chargebacks: Lower the incidence of chargebacks, preserving both time and financial resources.

- Enhanced customer experience: Offer a secure transaction environment, elevating customer confidence and satisfaction.

- Cost efficiency: Curtail operational expenses tied to fraud detection and management, promoting a healthier bottom line.

- Retention boost: Foster a secure transaction milieu, aiding in reducing customer churn and enhancing loyalty.

Once Kount’s Fraud Service is activated, Recurly initiates risk assessments for new card verifications, including sign-ups and billing info updates. Accounts with existing credit or debit cards will only be assessed if their billing information is updated.

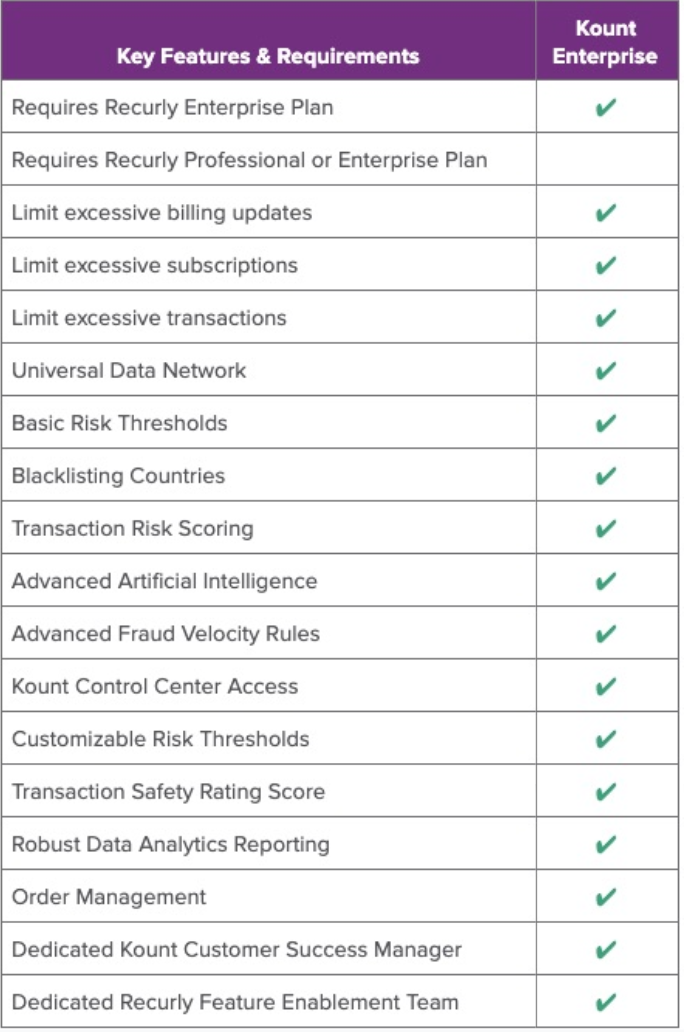

Kount Enterprise

For businesses seeking a robust and customizable fraud management solution, Kount Enterprise is the ideal choice. It offers the foundational fraud prevention technology of Kount Basic, enhanced with direct access to your Kount Control Center and a dedicated Kount Customer Success Manager. With Kount Enterprise, you can:

- Create custom rules based on observed fraud trends and specific business policies.

- Access Kount’s business intelligence tools for comprehensive analysis.

- Conduct manual reviews for transactions.

- Leverage Kount's advanced artificial intelligence scoring for improved fraud detection.

How does it work?

Upon activation, for every new card transaction, Recurly communicates with Kount’s Fraud Service, sharing essential transaction details like IP address, email address, shipping address, card details or apple pay tokens, billing info, and more.

Kount processes this data using its proprietary AI, applies your custom rules, and returns a risk decision. Recurly respects this decision: if Kount advises declining the transaction, Recurly halts the process, avoiding the payment gateway. If approved, Recurly continues with the transaction, forwarding details to the payment gateway.

Kount has additional layers of fraud protection in Kount Enterprise. Contact Kount to learn more about this offering and then, to integrate Kount Enterprise with Recurly, reach out to Recurly's onboarding team.

High Risk Decline Settings

When using fraud settings related to Kount inside Recurly Admin, within Decline Thresholds Rules, there is an option to reject / decline High Risk transactions when Kount does not explicitly state to decline the transaction. If this checkbox is not checked, Recurly will not reject low score transactions unless Kount return instruction to Decline the transaction.

Updated 17 days ago