Prepaid account balance

Discover the power of the Prepaid Account Balance, a feature that revolutionizes cash flow management by allowing your subscribers to prepay for their future purchases and avail discounts.

Overview

Required plan

This feature is available to all customers on any Recurly subscription plan.

Prerequisites

Features 'Credit Invoices' and 'Only Bill What Changed' must be enabled to use the prepaid account balance.

Definition

Prepaid Account Balance is a feature that enables customers to pay in advance, contributing to an account balance that can be used to settle future subscription and one-time purchase invoices.

Key benefits

- Immediate cash flow: Benefit from immediate cash flow generated through prepayments, enhancing your financial stability.

- Boosted customer acquisition: Enhance customer acquisition and conversion rates by offering discounts for prepaid amounts, making your offerings more attractive.

- Reduced transaction costs: Achieve a significant reduction in transaction costs as there are no transaction fees or interchange charges when subscribers pay for purchases from their account balance, promoting cost-efficiency.

Key details

Setting up a prepaid account balance

This feature can be established using API V2, API V3, or through the Admin Console.

- For the V3 API, generate a Purchase request for a line_item with an "origin" = "prepayment".

- For the V2 API, formulate a Purchase for a charge adjustment with an "origin" = "prepayment".

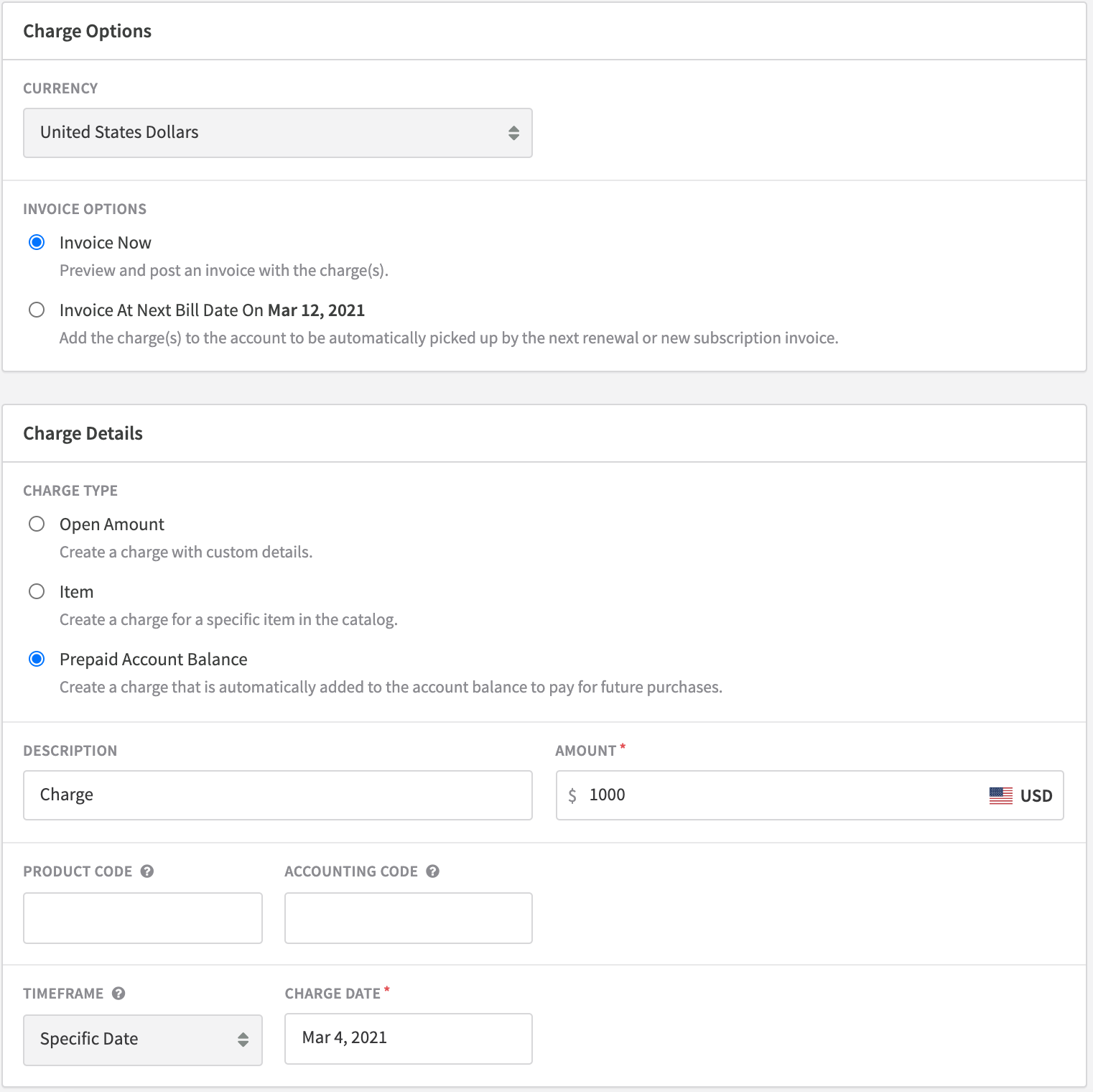

- In the Recurly Admin Console, you can create a charge with an immediate time frame. Choose Prepaid Account Balance, specify an amount, and preview the charge before creation.

When the purchase request is successfully processed, the transaction amount is added to the Account Balance. Future subscriptions and one-time purchases will be deducted from this balance until it's depleted. If the purchase transaction fails, the invoice will be marked as failed and will undergo a dunning process for collection.

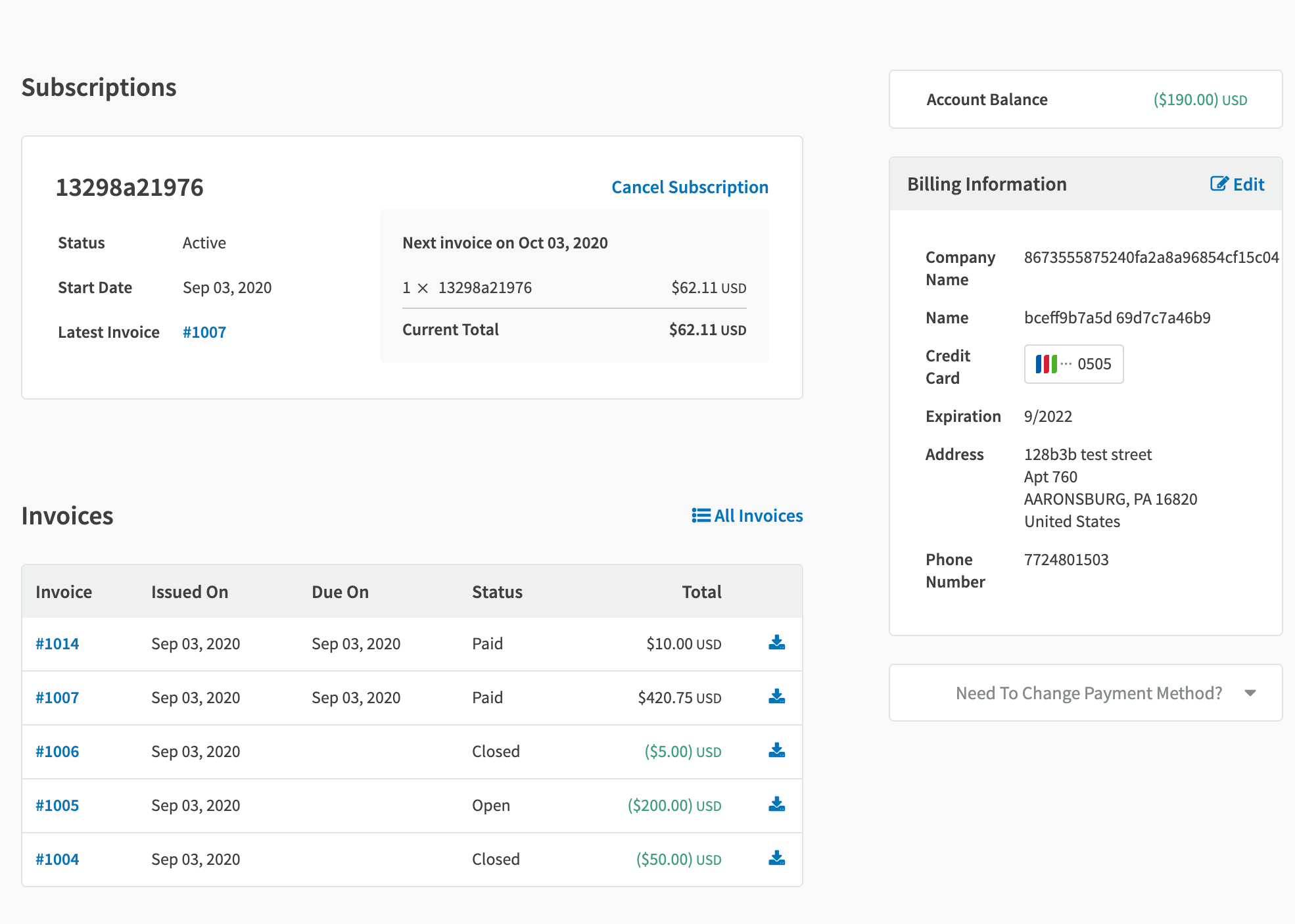

The Hosted Account Management page will display the account balance, active subscriptions and all associated invoices to provide clarity for subscribers.

Considerations for prepaid account balances

- Prepaid balances should be tax-exempt. Taxes will be applied on an invoice when necessary when the actual product/service is sold.

- Do not mix purchase requests to add to the prepaid account balance with other line items.

- Purchase requests for the prepaid account balance must be invoiced immediately, not at renewal.

- Prepaid account balances cannot fund additional account balances. Subsequent prepaid account balance purchases will not use these balances.

- Revenue Recognition for account balance must be managed by the merchant.

- Refer to Adjustments to understand how credits and account balance are applied on invoices.

Manual invoices and prepaid account balance

For manual collection methods, the account balance remains in a processing state until the manual payment is collected.

Asynchronous payment methods and prepaid account balance

Prepayments made through the UI, ACH, and other direct debit payment methods will not fund the prepaid balance until Recurly receives a successful transaction notification.

Refunds

Refunds are possible for prepaid account balances that haven't been utilized. The refund will be directed back to the original payment method.

Updated about 1 year ago