Expired card management

Automate the management of expired cards to boost revenue, reduce churn, and enhance subscriber experiences.

Overview

Required plan

This feature or setting is available to all customers on any Recurly subscription plan.

Prerequisites

- Active Recurly account with necessary permissions.

- Subscription analytics enabled for tracking recovery rates.

Limitations

- The success rate of automatic card updates may vary based on the card issuer and network.

- Not all credit cards may support automatic updates.

Definition

Expired card management is a feature in Recurly that proactively updates expired credit card information, ensuring uninterrupted subscription renewals and reducing transaction failures due to outdated card details.

Key benefits

- Enhanced subscriber experience: Subscribers enjoy uninterrupted access to services without manual card updates.

- Reduced churn: Minimize involuntary churn caused by an expired card.

- Revenue protection: Prevent potential revenue loss from failed transactions.

- Insightful analytics: Monitor and analyze the effectiveness of the feature through the Recovered Revenue dashboard.

Key details

Managing expired cards for smooth renewals

For people using subscription services, continuous access is usually a top concern. Recurly's Expired Card Management tool steps in to prevent hiccups caused by card expirations, helping to make the renewal process easy and seamless.

Reducing payment issues

Recurly implements a unique strategy to reduce transaction failures that occur when credit cards expire before the upcoming billing cycle. By temporarily extending the expiration date on these cards, it helps prevent interruptions in subscription payments, ensuring that services remain active without any glitches. This approach is designed to provide a buffer, giving subscribers ample time to update their card details without facing service disruptions.

Building trust and reducing churn

Being proactive about card expirations helps in two ways: it safeguards your earnings by lowering the churn rate, and it builds trust with your subscribers. When people see that you are working to prevent any service interruptions, it creates a feeling of reliability and trust.

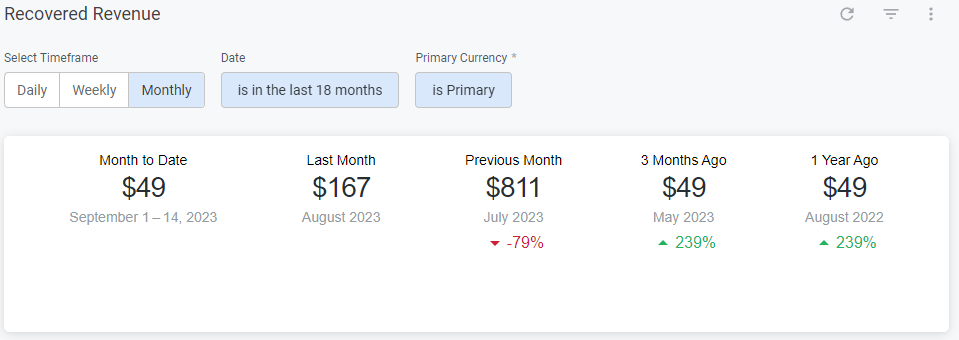

Insight into Revenue Recovery

The tool also offers dashboards that allow you to delve deep into the revenue preserved through the proactive management of expired cards. These analytics aid in understanding how effective the management tool is in sustaining revenue and can offer insights into areas for further improvement. By keeping a close eye on these metrics, businesses can fine-tune their strategies to enhance both subscriber satisfaction and revenue retention.

Expired card management implementation guide

Expired Card Management

- This is a feature that applies to all accounts. No setup is necessary.

Monitoring Revenue Recovery

- Access the Analytics section in the Admin Console.

- Navigate to Payment Orchestration.

- View the Recovered Revenue dashboard to analyze the effectiveness of the Expired Card Management feature.

By following these processes, businesses can ensure that their subscribers enjoy uninterrupted services, thereby solidifying their relationship and trust.

FAQs

Q: How does Recurly manage expired credit cards?

A: Recurly facilitates smoother transactions by selecting a future date for expired cards, rather than automatically updating them, which decreases the likelihood of payment failures and hard declines. This ensures clarity and avoids confusion with account updater services.

Q: How does this feature curb involuntary churn?

A: Involuntary churn arises when outdated payment details lead to transaction failures. By perpetually updating credit card details, the likelihood of transaction failures diminishes, subsequently reducing churn.

Q: Can we gauge the revenue salvaged using Expired Card Management?

A: Absolutely! Recurly's subscription analytics provides insights into recovery rates, showcasing the effectiveness of both retry logic and subscriber updates.

Updated about 1 year ago