Reports - Revenue Recognition Standalone

Recurly Revenue Recognition Standalone reports: Comprehensive insights for informed financial decisions.

Overview

This feature is part of our product, Recurly Revenue Recognition Standalone. [Learn more here].

Required plan

The Standalone Revenue Recognition module is available to merchants who need a Revenue tool to automate their ASC 606 / IFRS 15 accounting but do not, at this time, need the Recurly billing platform.

Cost

Please reach out to [email protected] for more pricing details.

Prerequisites

- Understanding of product bundling and data rule configurations.

- Knowledge of the desired attributes for dataset creation.

Limitations

- Any changes that are made will be applied for future transactions only.

- If changes are made to the revenue data, it can take up to an hour for those changes to be reflected in the reporting.

- Once a dataset is created, it cannot be deleted, only inactivated.

- Data Rules in Recurly Revenue Recognition Standalone cannot be deleted but can be set to an inactive status.

Key benefits

- In-depth analysis: Dive deep into financial data with detailed reports on revenue, costs, variable considerations, and more.

- Customizable views: Configure reports based on specific attributes and save layouts for future use.

- Audit and compliance: Access audit reports to ensure adherence to financial standards and regulations.

- Exception handling: Identify and address exceptions with dedicated reports for SSP and holds.

- Strategic decision making: Leverage comprehensive insights to make informed financial and operational decisions.

Definition

Recurly's reporting module offers a plethora of detailed reports that cater to various financial and contractual needs. From revenue insights to transaction details, these reports provide a comprehensive view of an organization's financial landscape. They are designed to offer insights into revenue recognition, contractual balances, costs, variable considerations, and more. With an intuitive interface, users can configure, save layouts, and generate reports tailored to their specific requirements.

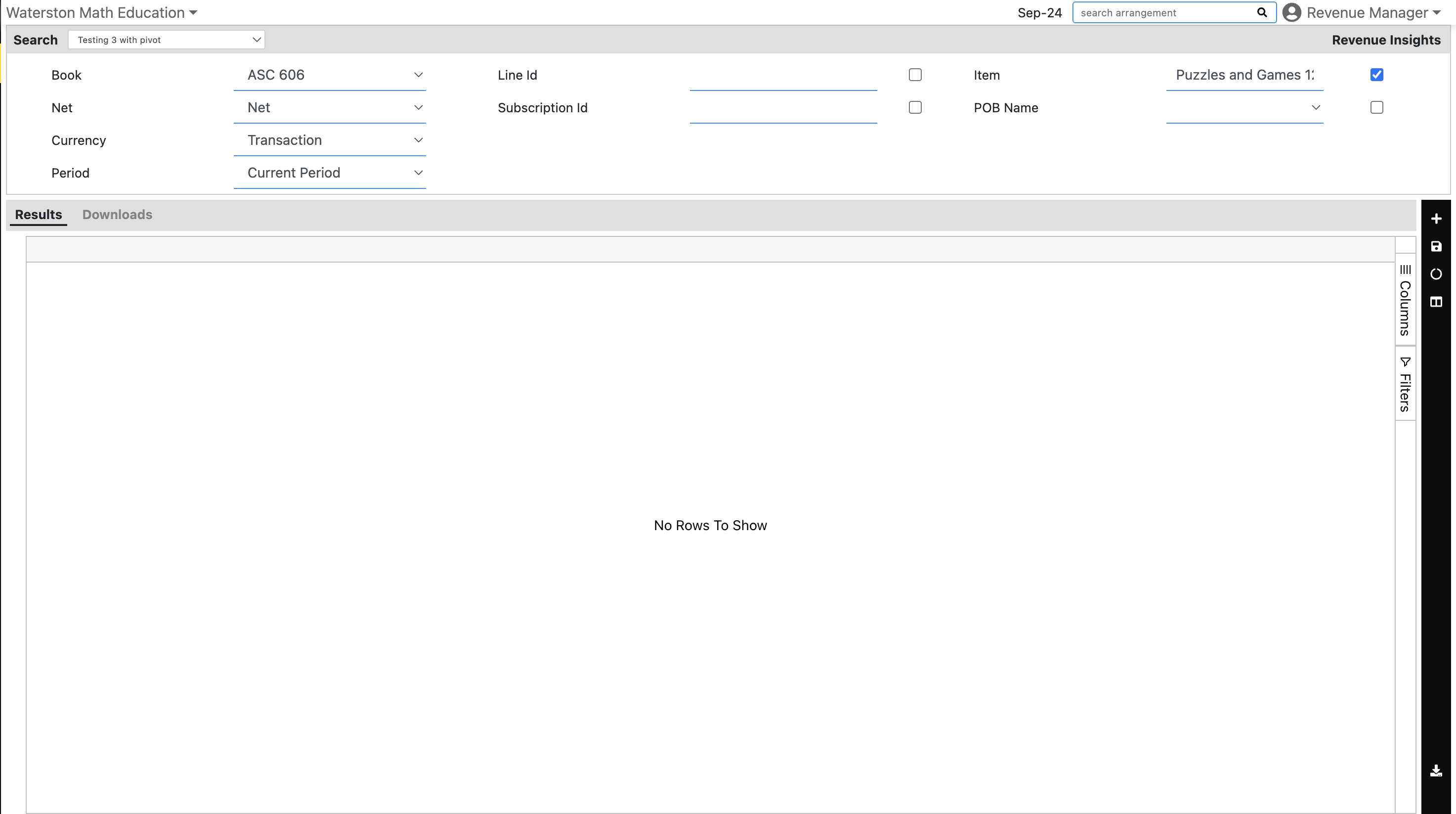

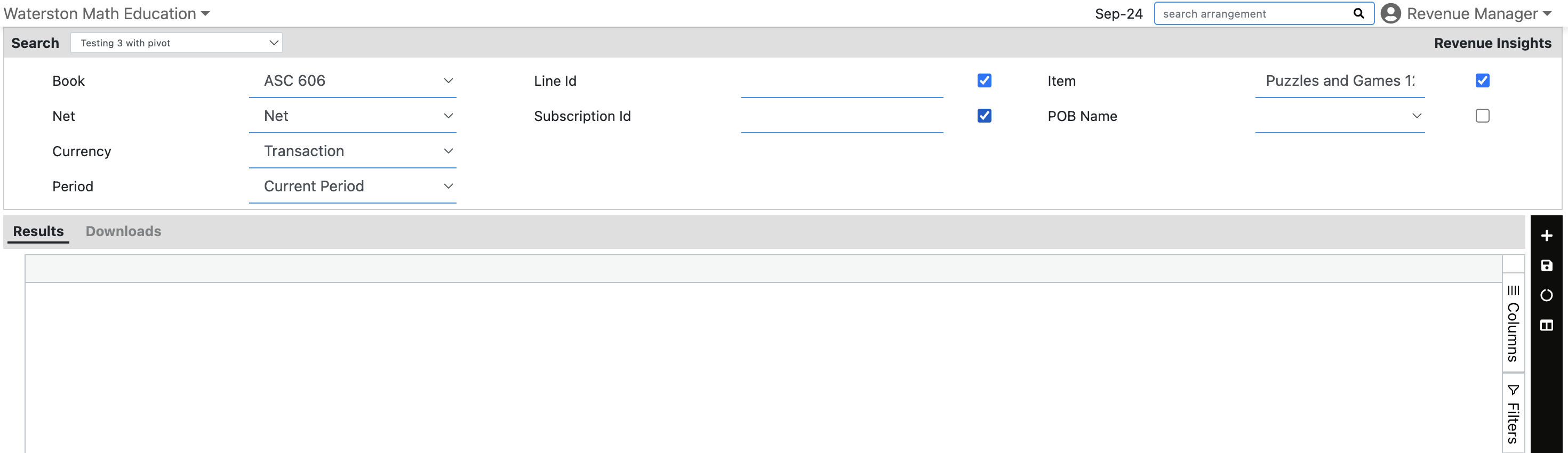

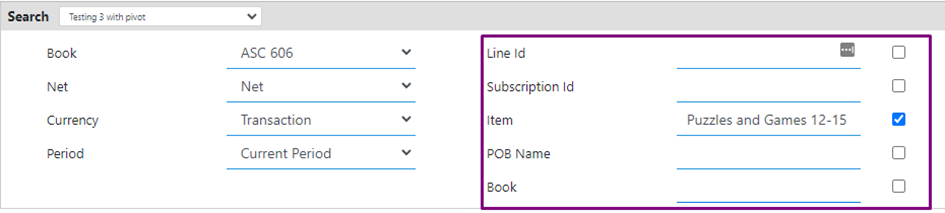

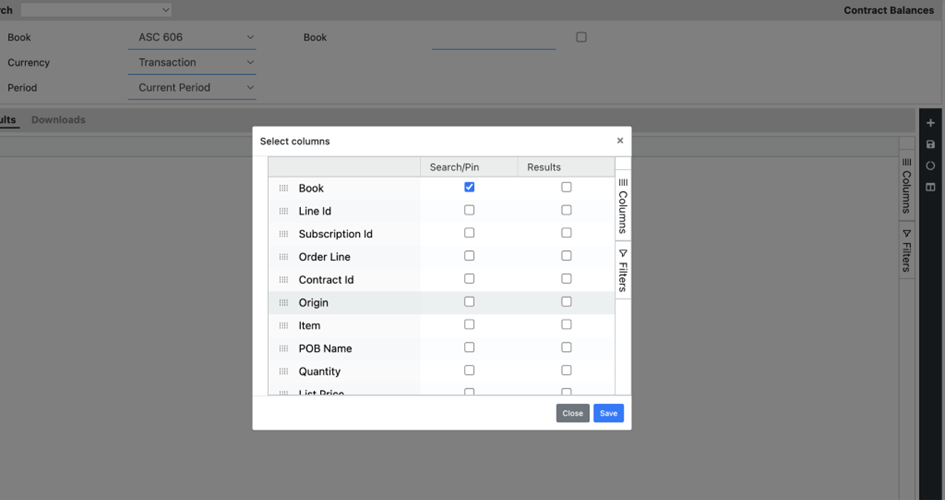

Configuring reports

-

Navigate to the Reports section and select the desired report from the available options.

-

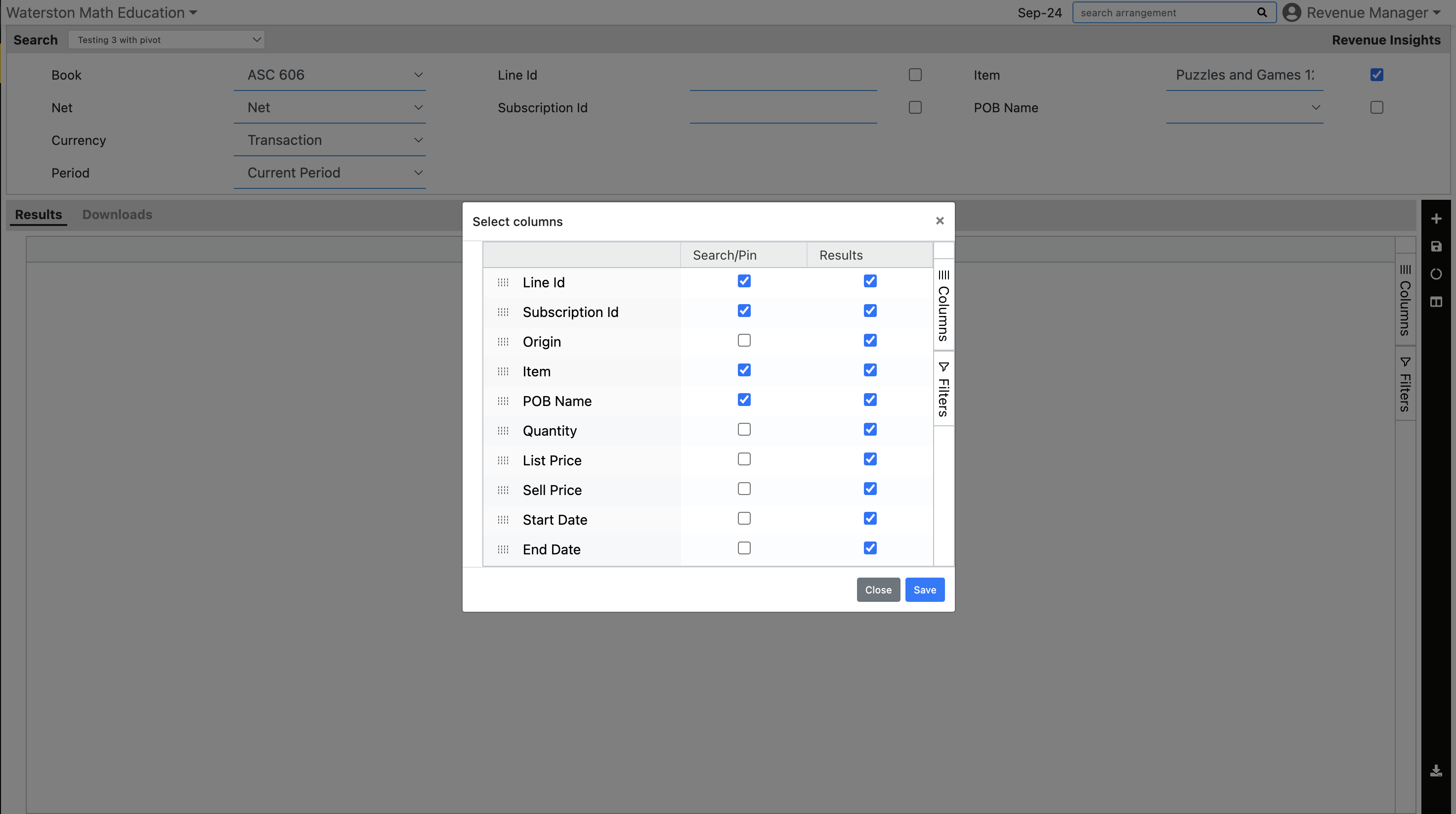

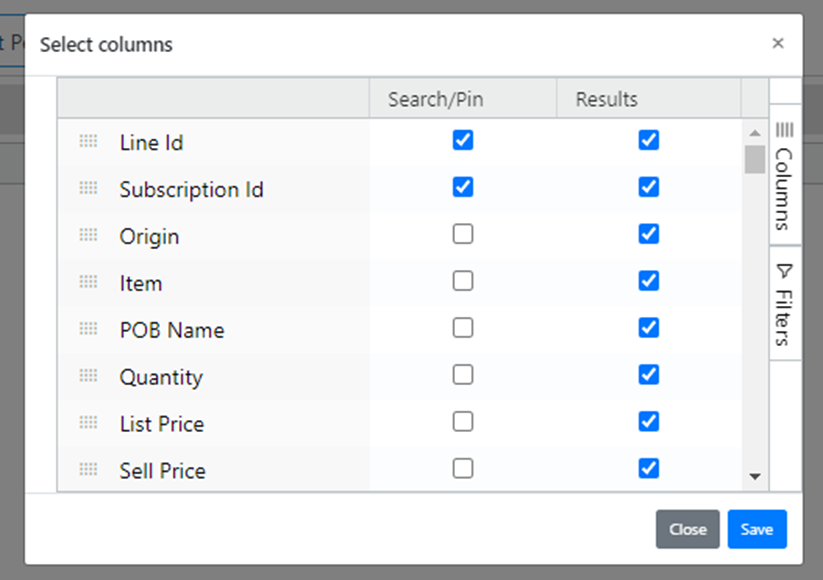

Click on the Mapper icon, and a dialogue box will appear displaying the available attributes.

-

Select the attributes you want to view under the Search/Pin & Results column, and click on Save to save your selections.

-

Enter any search criteria you want to apply to the report, or leave it blank for a complete report.

-

Select the desired requirements for the report and click on the Run button to generate the report.

- Once the report is generated, click on the Download Icon to download the report in your preferred format.

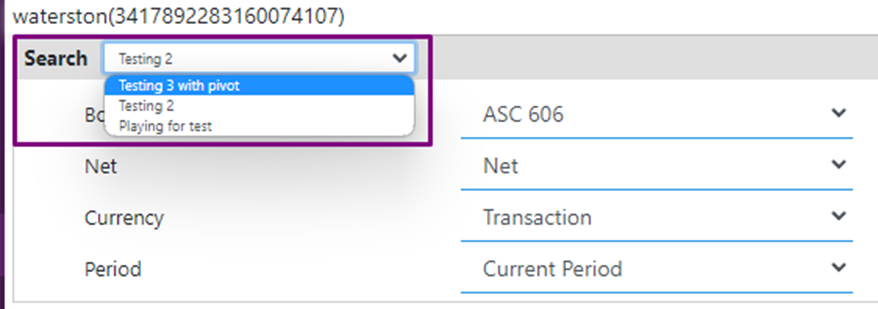

How to save layouts in reports

By saving layouts, you can customize and store different views of the reports based on your preferences and analysis needs.

- Open the desired report; click on the mapper icon, and check the attributes you want to include in the report. Drag and arrange them in the desired order.

-

Apply any necessary search criteria to filter the data.

-

Click on the Run button to generate the report with the selected layout.

-

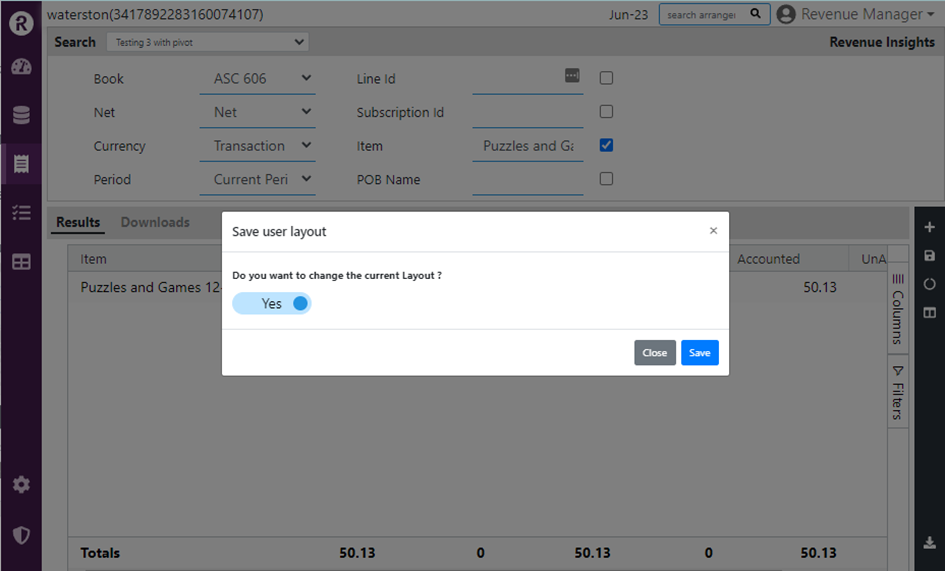

On the right-side bar, click on the Save Layout option.

-

Your layout is now saved. To access it, click on the drop-down menu in the upper left corner next to Search. Your saved layouts will be listed there.

-

If you want to save another layout, make changes to the filter or columns as desired, and click on Save again. This time, untick the "Yes" option (toggle it to "No") to save it as a new layout.

Revenue reports

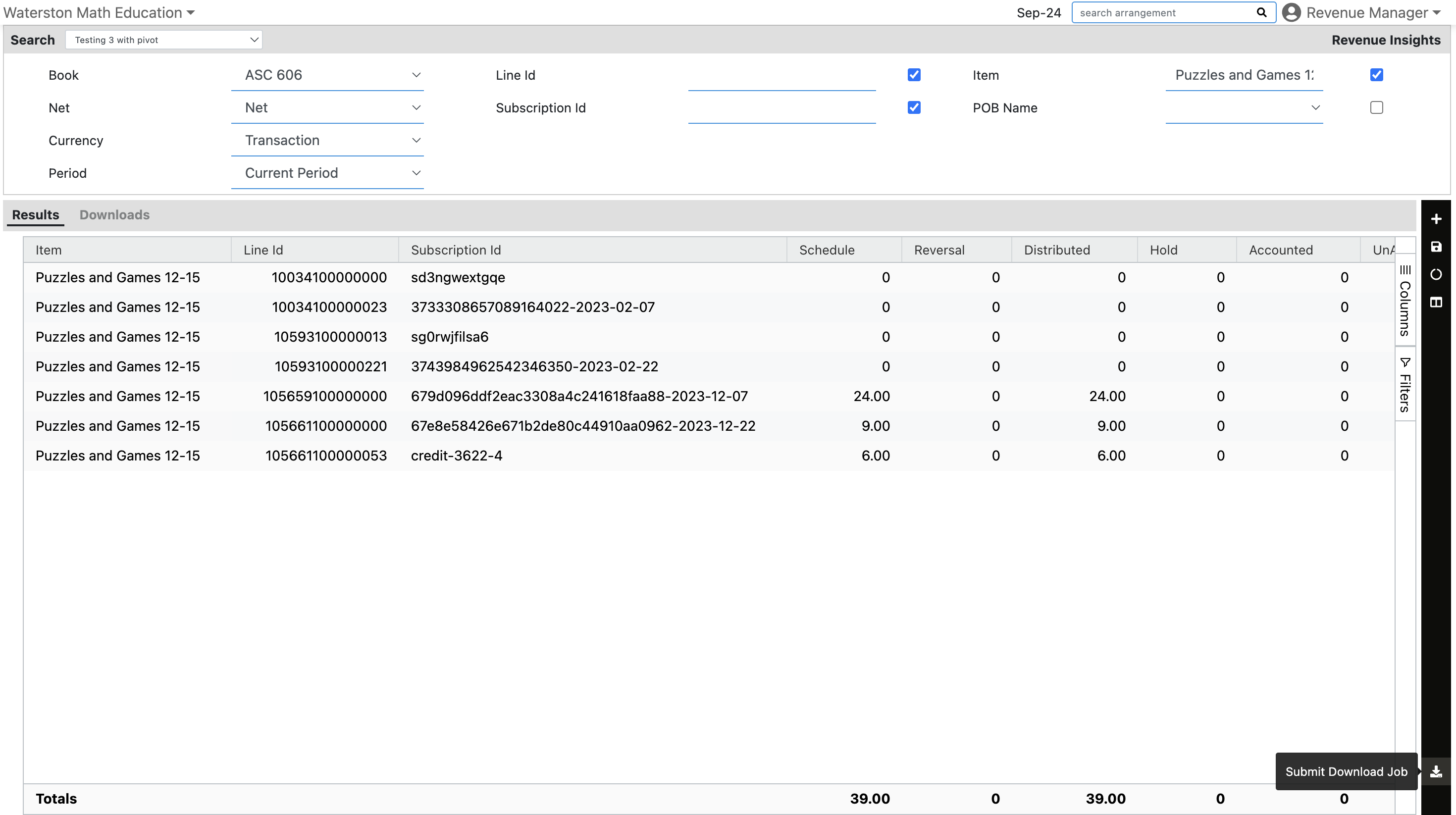

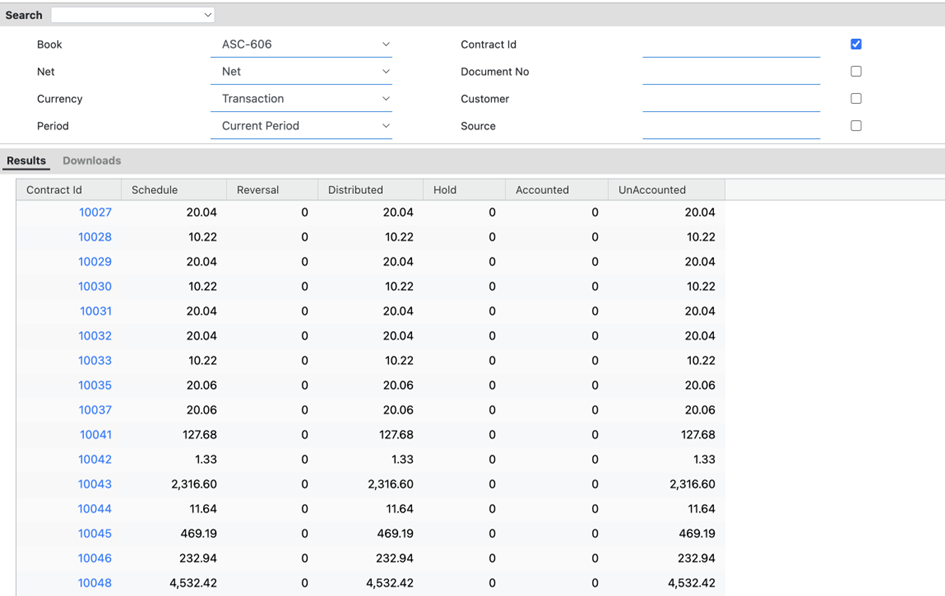

Revenue insights report

The revenue insights report provides a comprehensive overview of revenue distribution, comparing it to scheduled revenue and accounting details. This report enables merchants to track reversals, holds, and unaccounted revenue. The default columns in this report include:

- Schedule: Displays the scheduled revenue amount.

- Reversal: Shows any revenue reversals that have occurred.

- Distributed: Represents the distributed revenue amount.

- Hold: Indicates revenue that is on hold or pending.

- Accounted: Reflects the revenue that has been accounted for.

- Unaccounted: Highlights any revenue that is yet to be accounted for.

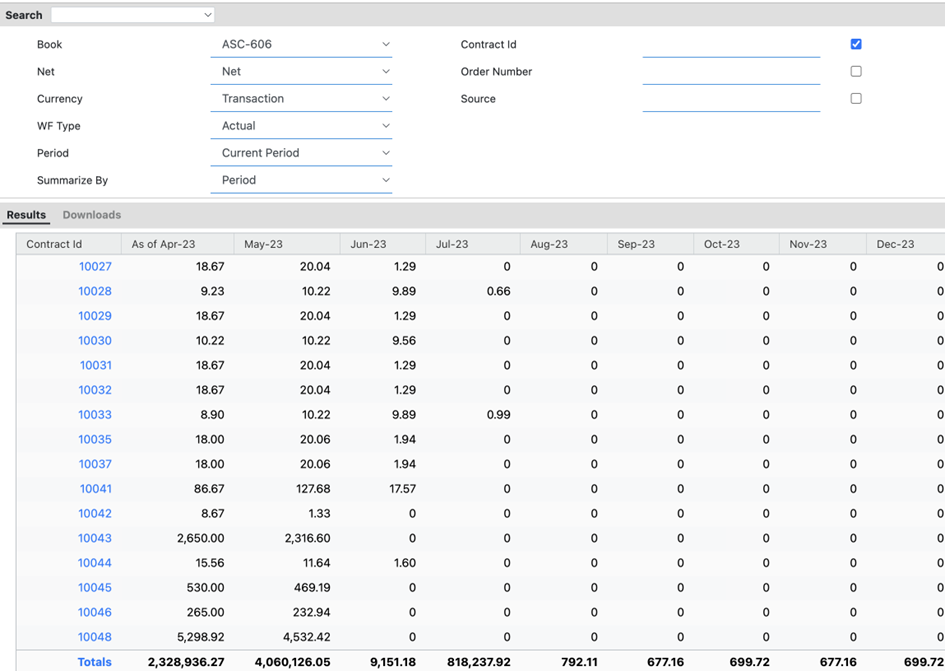

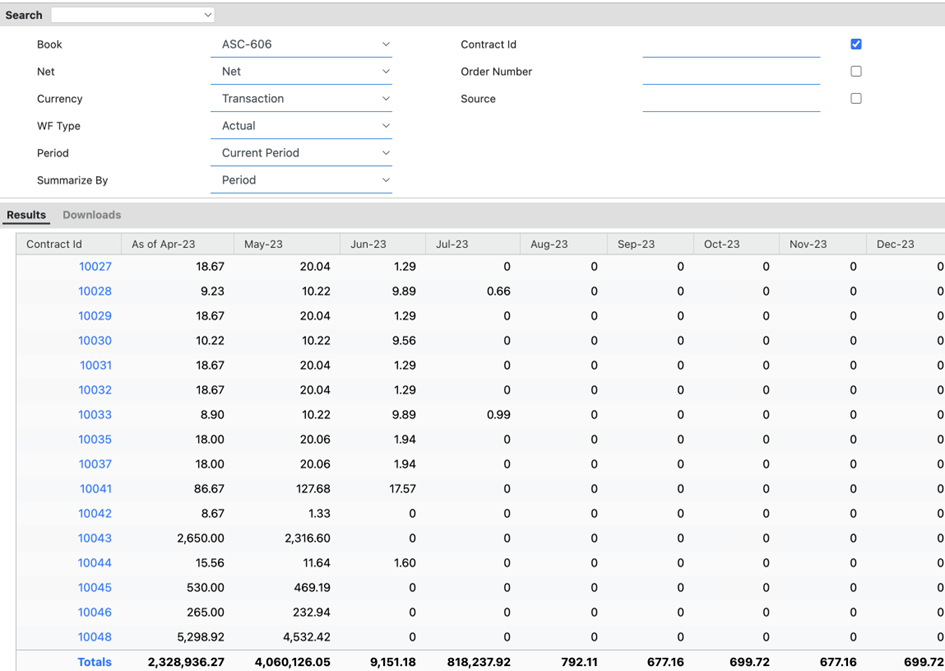

Revenue waterfall report

Checkout our step-by-step guide to leverage the waterfall report feature:

The revenue waterfall report provides a visual representation of revenue recognition throughout the contract period. This report showcases the revenue recognized from the start date to the end date of the contract. It displays the balances of the revenue lines, starting from the selected period and extending until the contract's conclusion.

By presenting the revenue waterfall, this report allows you to track the progression of revenue recognition over time. It provides a comprehensive view of how revenue is distributed and accumulated throughout the contract duration. This report is valuable for monitoring revenue performance, identifying trends, and gaining insights into the revenue dynamics of the business. With the Revenue Waterfall Report, businesses can make informed decisions and optimize their revenue recognition strategies.

The Results in the report generated can be viewed by period, quarter and year using the Summarized by Feature option. The dropdown menu offers Period, Quarter and Year options.

Single period: If you select to view the report by Period, then you simply select the correct period under Period. Then the data in the report will be generated for that period.

Quarter: If you select to view the report by quarter. Then the data of the contracts in the selected periods will be disclosed in a quarterly manner. Eg: Q1-24, Q2-24.

Year: If you select to view the report by Year. Then the data of the contracts in the selected periods will be disclosed in a yearly manner. Eg: 2024, 2025.

Defer revenue waterfall report

The defer revenue waterfall report allows you to gain insights into the amount of revenue that will be deferred within a specific contract period, representing unrecognized revenue. This report helps you visualize the revenue waterfall for a given period and understand the remaining deferred balances over time.

By examining the deferred revenue waterfall, you can assess the distribution and accumulation of deferred revenue throughout the duration of your contracts. This report provides valuable information for understanding your revenue recognition pattern and identifying the remaining balance of deferred revenue for each period.

Reports on balances

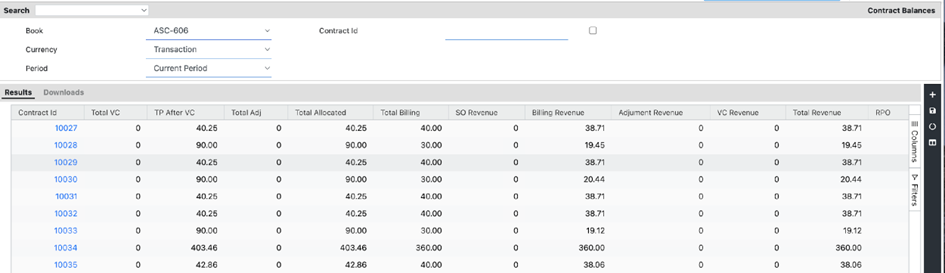

Contract balances report

The contract balances report provides insights into the changes to contract assets and contract liabilities within a specified period. This report helps you understand the financial dynamics of your contracts by disclosing key information related to revenue, billing, adjustments, and more.

The default columns in the contract balances report include:

- Total VC: Displays the total variable consideration for the line.

- TP after VC: Transaction price after adjustments of favorable and unfavorable variable considerations.

- Total Adjustment: Calculated as Transaction Price minus Allocated Amount, representing carve-out.

- Total Allocation: Amount of transaction price allocated based on SSP (standalone selling price).

- Total Bill: Sum of total invoices issued.

- SO Revenue: Revenue recognized for the period.

- Billing Revenue: Amount of revenue recognized for which the right to bill exists.

- Adjustment Revenue: Carve-out amount to be adjusted with respect to the recognized revenue.

- VC Revenue: Amount of variable consideration recognized for that period.

- Total Revenue: Sum of SO Revenue, Billing Revenue, Adjustment Revenue, and VC Revenue.

- RPO (Remaining Performance Obligation): Amount of remaining revenue to be realized upon satisfaction of performance obligations.

- Liability/Asset: If the balance at the end is positive, it represents a liability; otherwise, it is a current asset.

- Current Asset: Revenue recognized for the period minus receivable.

- Current Liability: Invoice issued minus revenue recognized.

- Revenue on Hold: Revenue that is currently on hold.

- Accrual AP (Accounts Payable): Represents accrued expenses.

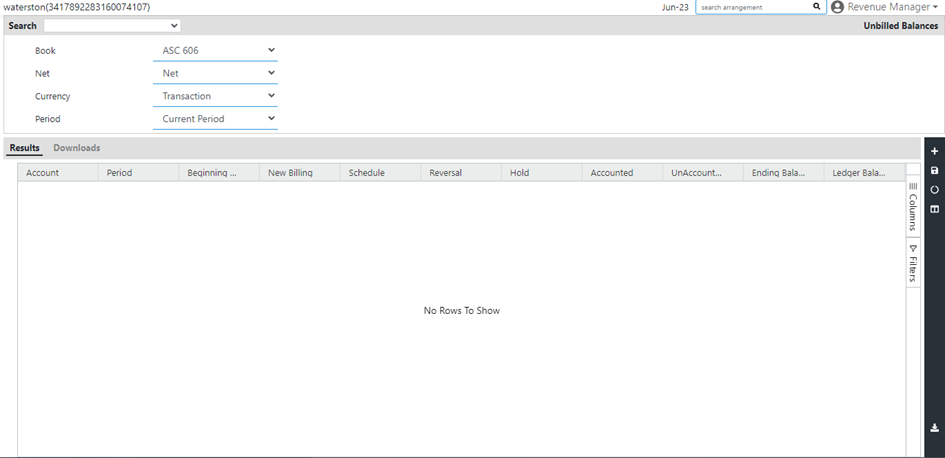

Unbilled balances

The unbilled balances report provides comprehensive information regarding unbilled transactions, offering a complete overview of contractual revenue that has not yet been billed. This report is a crucial component of the contract balance report, presenting beginning and ending balances as well as activity details.

The Unbilled Balances Report includes the following default columns:

- Beginning Balance: Represents the balance from the previous period.

- New Billing: Reflects the billing amount for the current period.

- Schedule: Indicates the revenue scheduled for recognition in the current period.

- Reversal: Displays the revenue that has been reversed in the current period.

- Hold: Represents the revenue currently on hold.

- Accounted: Shows the revenue accounted for in the current period.

- Unaccounted: Represents the revenue that has not yet been accounted for in the current period.

- Ending Balance: Calculated as the sum of the beginning balance, new billing, and scheduled revenue.

- Ledger Balance: Represents the corresponding line balance in the ledger.

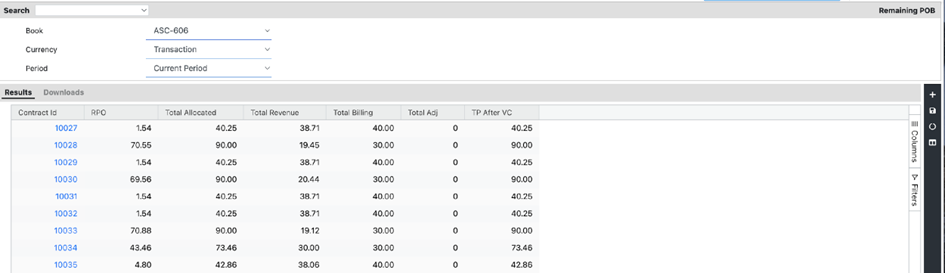

Remaining POB

The Remaining Performance Obligation (RPO) Report provides detailed information about the performance obligations (POBs) within a contract that still have remaining balances due to unsatisfied or partially satisfied obligations at the end of the period. This report includes the following details:

- RPO: Represents the remaining performance obligation balance for the period, indicating the amount that is yet to be recognized.

- Total Allocated: Displays the amount of Transaction Price (TP) allocated to each performance obligation based on the Standalone Selling Price (SSP).

- Total Revenue: Shows the total revenue recognized for the contract where the performance obligation has been satisfied during the period.

- Total Billing: Represents the sum of the total invoices issued for the contract.

- Total Adjustment: Calculates the carve-out amount by subtracting the Allocated Amount from the Transaction Price.

- TP after VC: Displays the transaction price after adjustments of favorable and unfavorable variable considerations.

This report provides valuable insights into the remaining balances and progress of performance obligations within a contract.

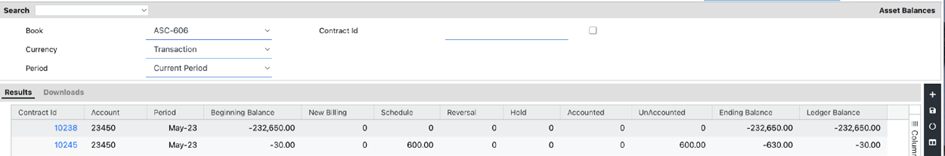

Asset balances report

The asset balances report provides a comprehensive view of the movement of contract asset balances during a specified period. This report includes the following default columns:

- Beginning Balance: Represents the balance from the previous period.

- New Billing: Displays the billing amount for the current period.

- Schedule: Indicates the revenue scheduled for recognition in the current period.

- Reversal: Represents the revenue reversed during the current period.

- Hold: Displays the revenue on hold.

- Accounted: Represents the revenue accounted for in the current period.

- Unaccounted: Indicates the revenue that is not yet accounted for in the current period.

- Ending Balance: Calculated as the sum of the beginning balance, new billing, and adjustments for the scheduled revenue.

- Ledger Balance: Represents the balance for the corresponding line in the ledger.

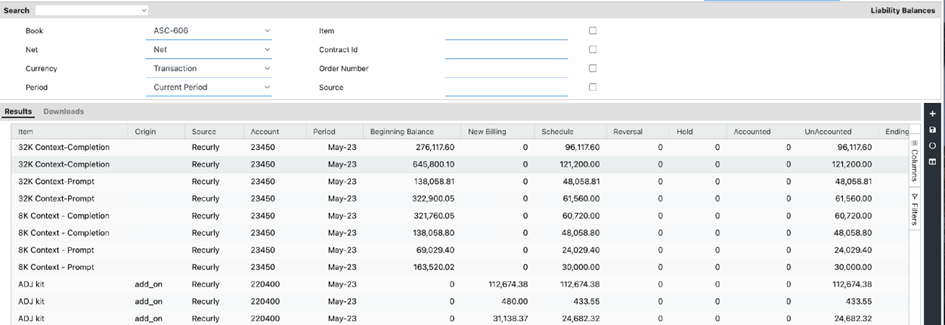

Liability balances

Checkout our step-by-step guide to leverage the liabilities balances report feature:

The liability balances report provides insights into the changes in contract liability for a specified period. A contract liability represents outstanding costs after payment is received. The report includes the following default columns:

- Beginning Balance: Represents the balance from the previous period.

- New Billing: Displays the billing amount for the current period.

- Schedule: Indicates the revenue scheduled for recognition in the current period.

- Reversal: Represents the revenue reversed during the current period.

- Hold: Displays the revenue on hold.

- Accounted: Represents the revenue accounted for in the current period.

- Unaccounted: Indicates the revenue that is not yet accounted for in the current period.

- Ending Balance: Calculated as the sum of the beginning balance, new billing, and adjustments for the scheduled revenue.

- Ledger Balance: Represents the balance for the corresponding line in the ledger.

Transaction details reports

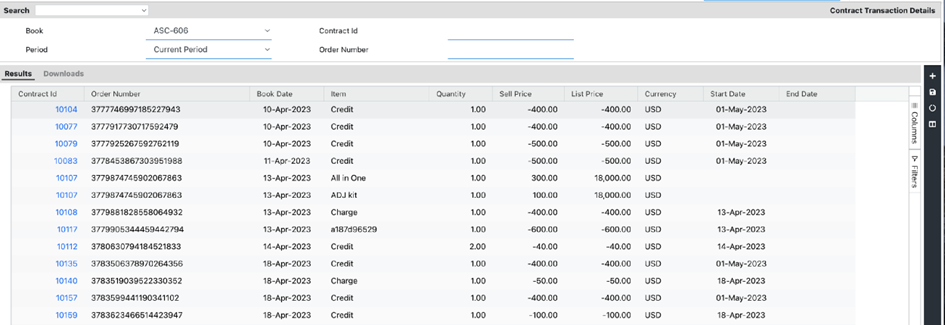

Contract transaction details

The contract transaction details reportprovides a comprehensive view of the selected contract(s). The report displays all the details based on the attributes selected in the mapper. It offers a comprehensive overview of the contract, including relevant information and data points for analysis and review.

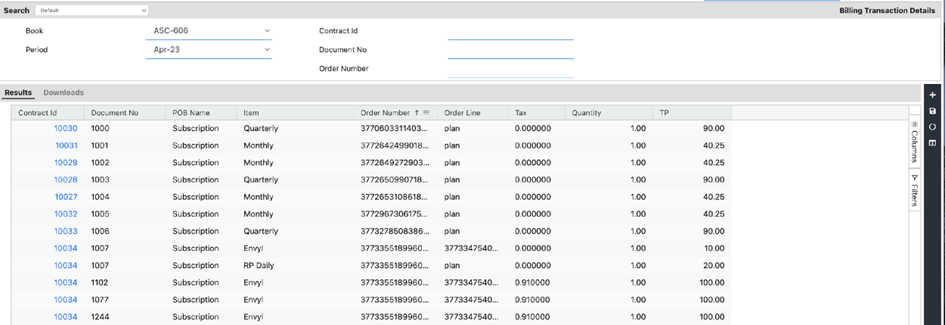

Billing transaction details

The billing transaction details report provides a comprehensive overview of the billings made during the selected period. It displays all the relevant details related to the billings based on the attributes selected in the mapper. This report allows for a detailed analysis and review of the billing transactions, providing valuable insights into the billing activity for further analysis and decision-making.

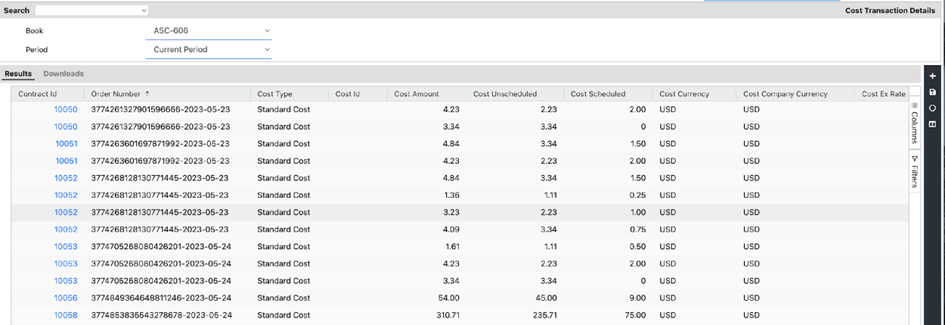

Cost transaction details

The cost transaction details report provides a comprehensive view of the cost transactions recorded during the selected period. It showcases all the relevant details associated with the cost transactions based on the attributes chosen in the mapper. This report offers valuable insights into the cost activities, allowing for in-depth analysis and evaluation of the cost transactions. By reviewing this report, you can gain a better understanding of the cost components and their impact on financial performance.

Cost reports

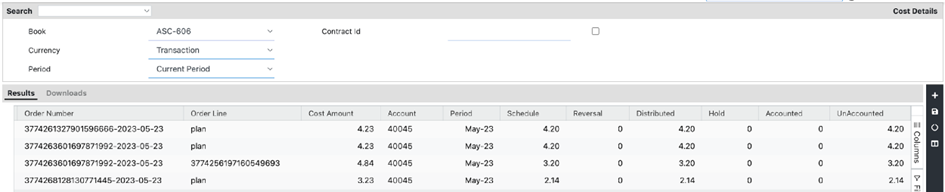

Cost details report

Cost details report provides a comprehensive overview of cost schedules for a specified period. This report includes default columns such as Account, Period, Schedule, Reversal, Distributed, Hold, Accounted, and Unaccounted, allowing you to analyze cost-related information in detail.

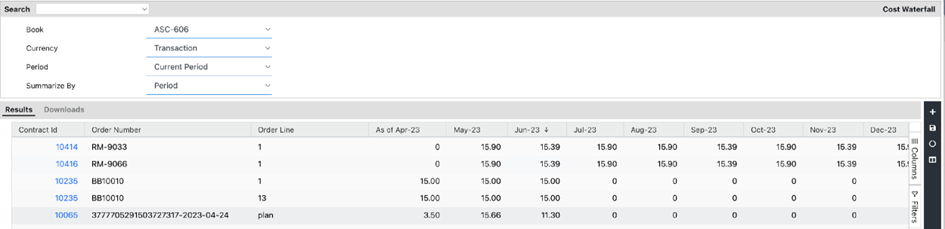

Cost waterfall report

Cost waterfall report showcases the waterfall of recognized costs for the contract period. It presents line-by-line balances, starting from the selected period until the end of the contract, enabling you to track the progression of costs over time.

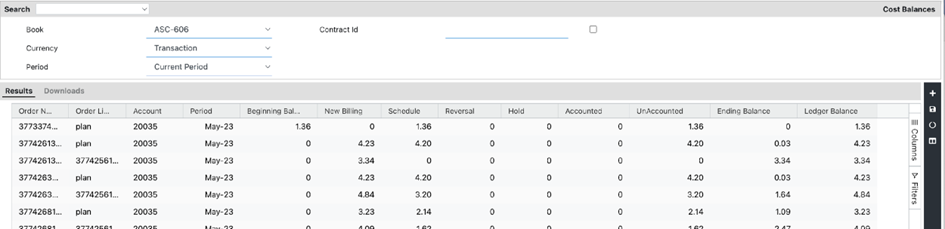

Cost balances report

Cost balances report presents the beginning, scheduled, and ending cost balances for the chosen period. This report provides insights into the overall cost position, allowing you to monitor cost changes and evaluate cost performance effectively.

VC reports

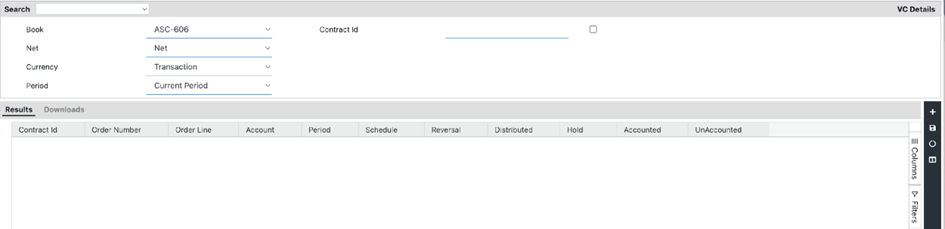

VC details

VC details report provides a detailed breakdown of variable consideration, including opening and closing balances, as well as price adjustments made during the specified period. This report allows entities to search and map data based on specific contract requirements or for a cumulative view across multiple contracts. Default columns such as Account, Period, Schedule, Reversal, Distributed, Hold, Accounted, and Unaccounted provide comprehensive information on variable consideration activity.

VC waterfall report

VC waterfall report illustrates the waterfall of variable consideration data, including prior period, current period, and future schedules. This report considers transactions linked to contracts, such as VC estimates or VC actuals. It offers flexibility in mapping the report to meet the specific needs of the entity.

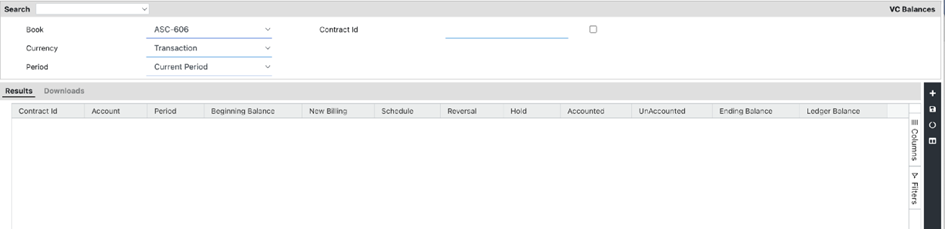

VC balances

VC balances report presents a summary of variable consideration actions taken during the period, such as VC estimates, true-up adjustments, reversals, and clearing. It provides a snapshot of the VC balance at the end of the period, helping entities track and monitor VC-related activities effectively.

Audit reports

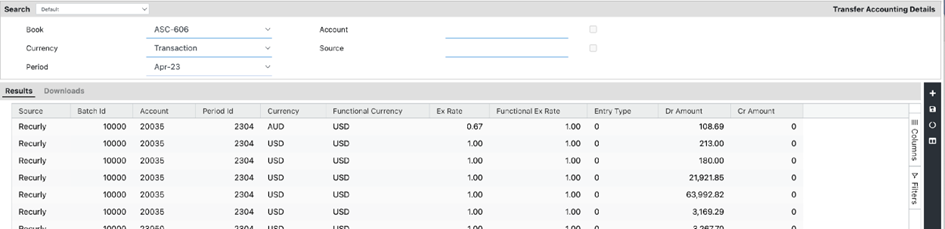

Transfer accounting details

Transfer accounting details report provides a comprehensive view of the Journal Entries passed, allowing users to analyze and review them on a monthly basis. This report offers detailed information about the Journal Entries, enabling entities to track and understand the accounting transactions in a customizable format. It assists in gaining insights into the transfer accounting process and facilitates detailed analysis of financial data.

Exception reports

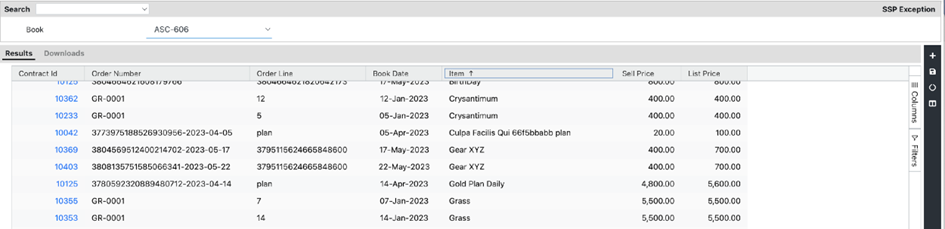

SSP exception

SSP exception report provides visibility into transactions that are not eligible for SSP (Stand-Alone Selling Price) allocation. This report displays transactions where the Allocation Flag is set to "No," indicating that the transaction does not meet the criteria for SSP allocation. It helps in identifying and addressing instances where SSP cannot be determined for certain transactions, enabling further analysis and appropriate actions.

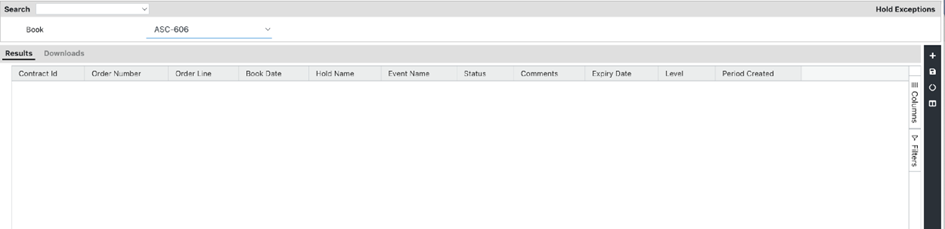

Hold exception

Hold exception report offers insights into transactions that are currently on hold. This report showcases the holds applied to specific transactions, including hold name, event name, hold status, and any associated comments. It helps in monitoring and managing transactions that are under hold, providing visibility into the reasons for the hold and facilitating the necessary actions to resolve the hold status.

Updated 3 months ago