Adyen

Harness the power of Adyen's global payment solutions, seamlessly integrated with Recurly, to elevate your business's payment experience.

Overview

Required plan

This feature or setting is available to all customers on any Recurly subscription plan.

Requirements

- Ensure you have your Business Entity Merchant Category Code filled in properly.

- Ensure you have set up your Adyen webhooks, user permissions, and Response settings properly within your gateway account or critical updates and response information will cause renewals and/or asynchronous payment methods to fail. Please follow all instructions in this document to avoid issues.

- Certain features require Adyen's V71 Checkout version, which is feature flagged in our system today. This will require you to capture CVV from return customers via API or Recurly.js. Please speak to Support for more information.

Limitations

Minimum processing requirementsAdyen has minimum processing requirements and business models they do not support. Please visit Adyen's website for more information to see if your business qualifies. For questions involving minimum processing requirements, please reach out to Adyen directly.

- Asynchronous payment methods might take 48 hours or more (dependent on the payment method) for confirmation.

- Use Recurly.js or the Recurly API for credit and debit card transactions.

- SEPA supports only EUR payments. Ensure SEPA transactions are in EUR.

- Certain features will not be available unless migrated to latest version of Adyen -- talk to Customer Support about enabling V71 for Adyen gateway.

Definition

Recurly's integration with Adyen allows businesses to leverage a robust, enterprise-level payment processor known for its extensive worldwide coverage. It simplifies credit/debit card processing, along with other payment methods, ensuring a frictionless experience for end-users.

Note: Visit our guide on testing your gateway configurations in Recurly to ensure your payment processes are set up correctly.

Key details

| Feature | Description |

|---|---|

| Services that work with Recurly | Credit/Debit cards, Recurring, Adyen Web Components, Adyen-derived Network Tokens, Revenue Protect / Protect Premium, MOTO Processing, Level 2/3 Processing |

| Supported operations | Authorize & Capture, Purchase, Refund, Verify, Void |

| Supported payment types | Credit/Debit cards, ACH, Boleto, iDeal, Klarna Debit Risk (only existing merchants), SEPA, Google Pay and Apple Pay, Cash App. Note: Only a subset of payment methods are supported in the new Adyen Components Recurly.js support. Excluded payment methods are: Klarna Debit Risk and Boleto. |

| Supported card brands | Visa, MasterCard, American Express, Discover, JCB, Diners Club, China Union Pay, ELO (BRL only), Hipercard (BRL only), Cartes Bancaires, Dankort, Bancontact |

| Gateway Specific 3DS2 Supported | Yes |

| Card on File Supported | Yes |

| Regions | Global |

| Currencies | All available. with special behavior for ISK and CLP. We do not support IDR and CVE. |

| Gateway Features | Network Token usage usage awareness (see notes), Revenue Protect / Protect Premium, MOTO Processing, Realtime Account Updater |

Setting up Adyen with Recurly

Ensure Adyen Settings are set properlyTwo features are necessary to ask Adyen Support to set properly:

- API PCI Payments role for your User. See Step 11.i below for more information.

- Skip CVC for your Merchant Account. See Step 11.ii below for more information.

Ensure a webservice user is set up on Adyen to permit Recurly to dispatch transactions to your gateway.

-

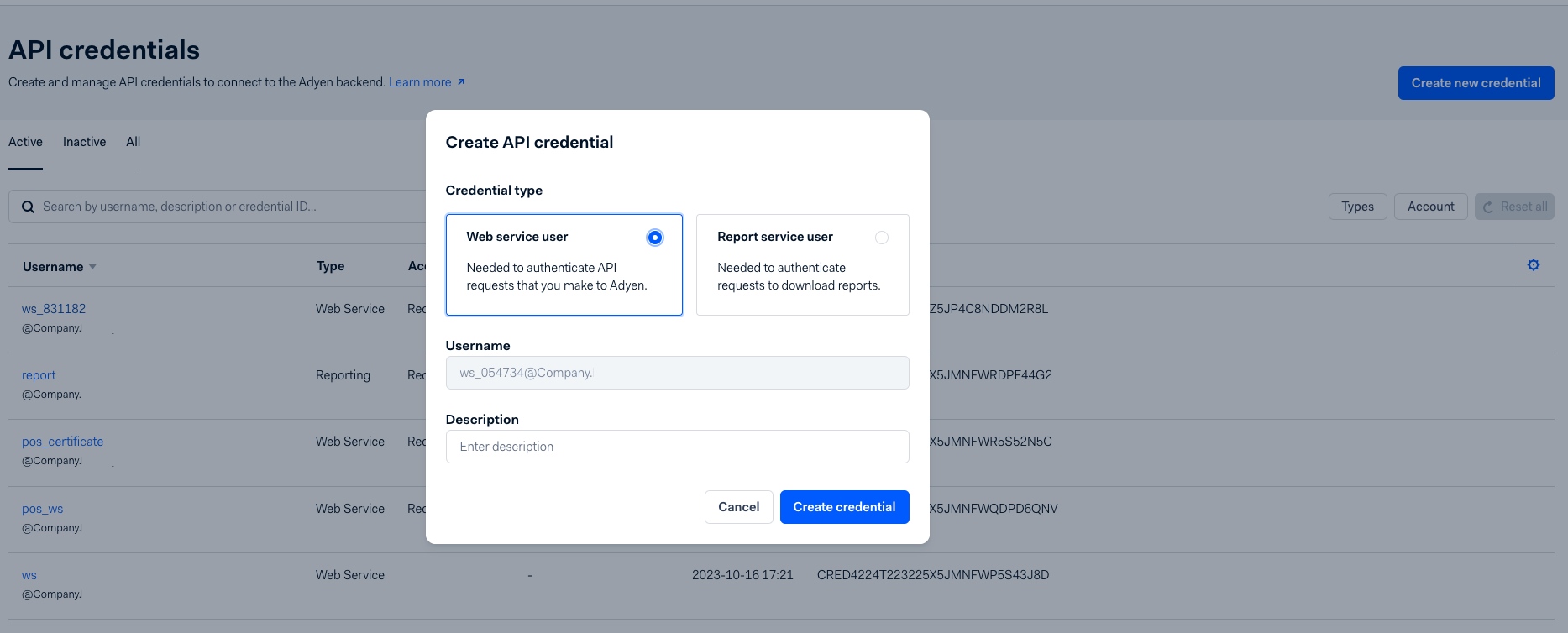

Access the Adyen dashboard.

-

Navigate to “Developers” → “API Credentials”.

-

Click "Create new credential".

-

In the modal that appears, select "Web service user" under "Credential Type".

-

Enter your user name and include a description if you wish. For example: Recurly Adyen Credentials

-

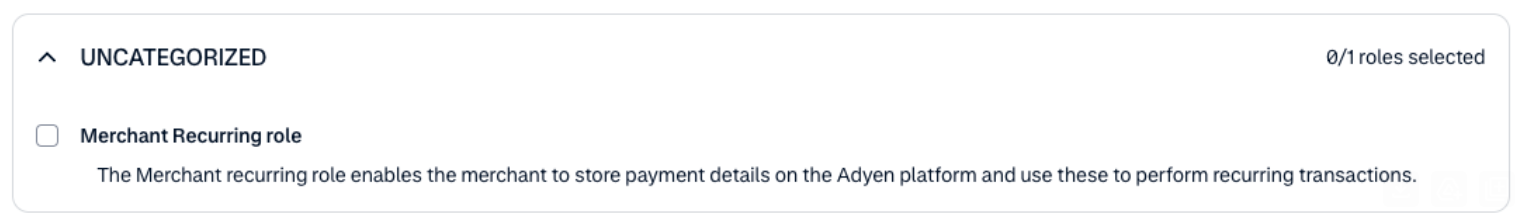

Ensure your API credentials have the 'Merchant Recurring Role' checked, or you will not be able to process recurring transactions using stored data within Recurly.

-

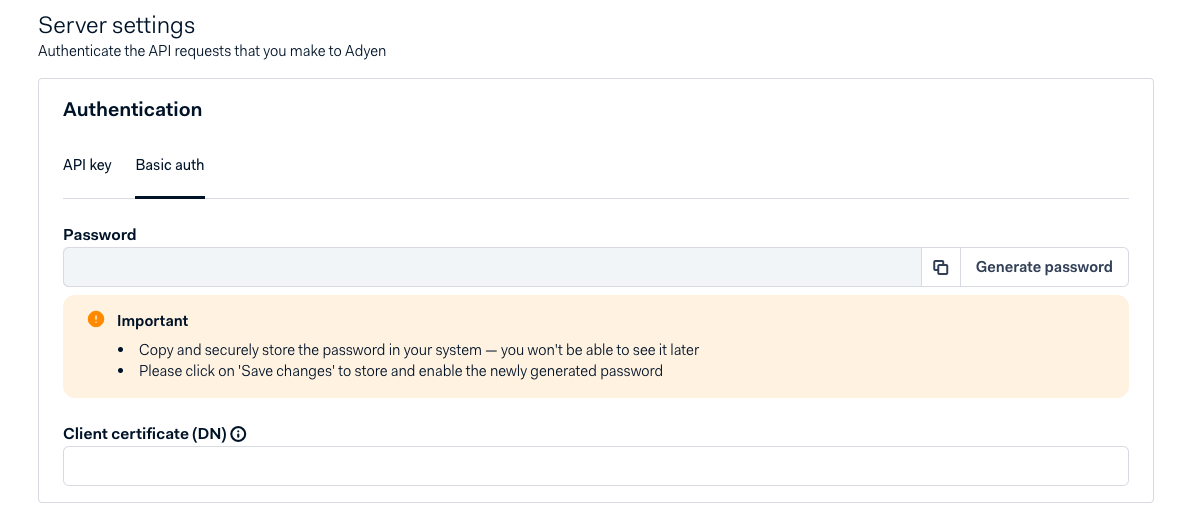

Your new credential will be created, and your password will be available under “Server settings” → “Authentication” → “Basic auth” on the subsequent page. You will not be able to access this password after leaving this page, so make note of it immediately. Otherwise, you will need to regenerate the password from this page.

-

Record the auto-generated username and password for later use in Recurly.

-

Click ‘Save changes’.

- In the "Risk" section under "Dynamic 3D Secure", update the Dynamic 3DS setting to "prefer no" unless you specifically wish to always require 3DS on your Adyen instance. You should not do this on a gateway instance where recurring billing is running

- For those adhering to the PSD2 Mandate, follow our Adyen-specific guidelines.

- Request

- Adyen support to activate the “API PCI Payments role” for your web services user, as it isn't active by default. Without this enabled, payments using a raw card number will fail.

- Adyen support to disable the CVC requirement on your Merchant Account if you do not collect CVC (CVV codes) from returning or known customers. If you do wish to collect CVC (CVV codes) on all Customer Initiated transactions, ensure your integration supports collecting and passing the code to Recurly via API if on v71.

- Additionally, ensure that “Acquirer Result” and “Raw Acquirer Result” are enabled in the API responses.

Adyen Webhooks configuration

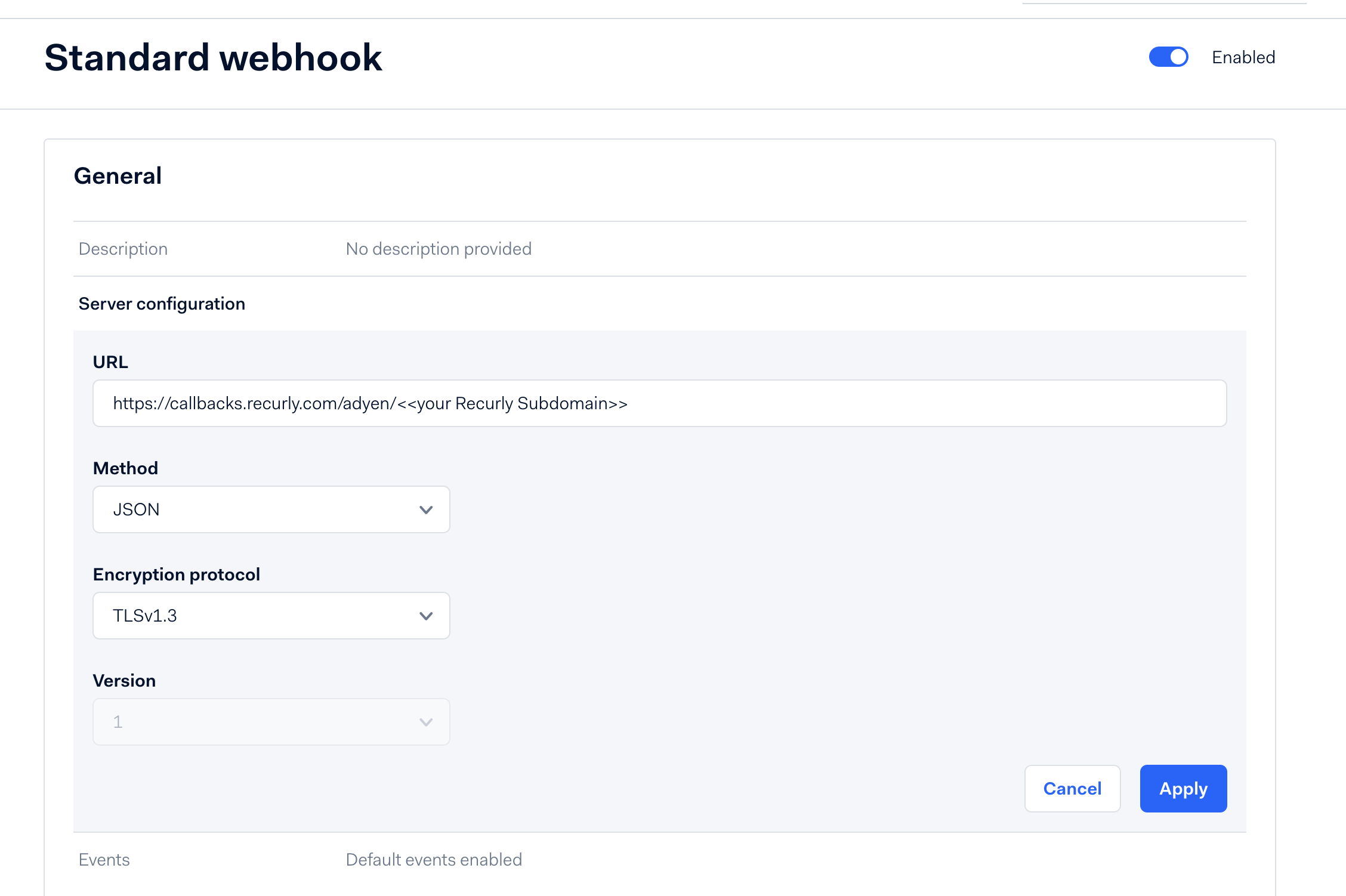

Accurate configuration of the callbacks URL is pivotal for Recurly to receive apt status updates for transaction records.

- Navigate to “Developer” >> “Webhooks”.

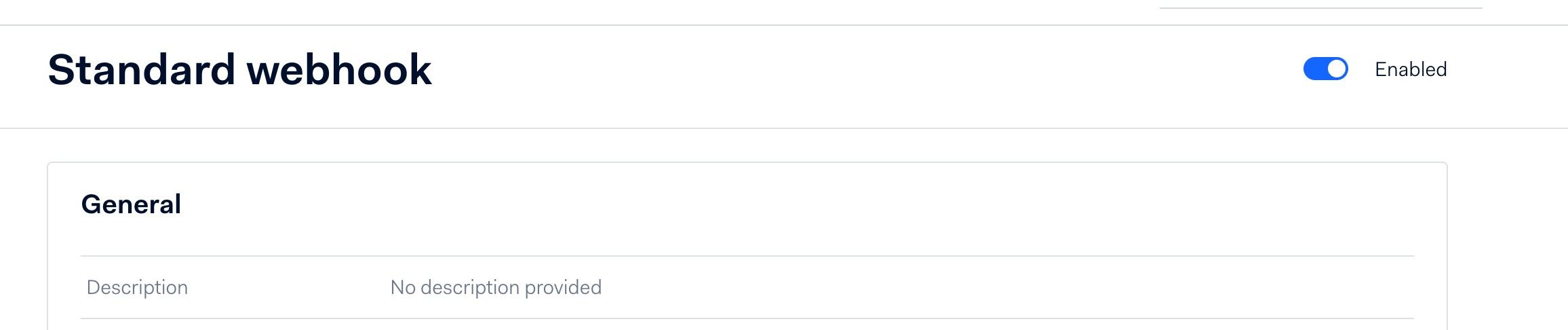

- Click “+ Webhook” and find "Standard webhook" and click "Add".

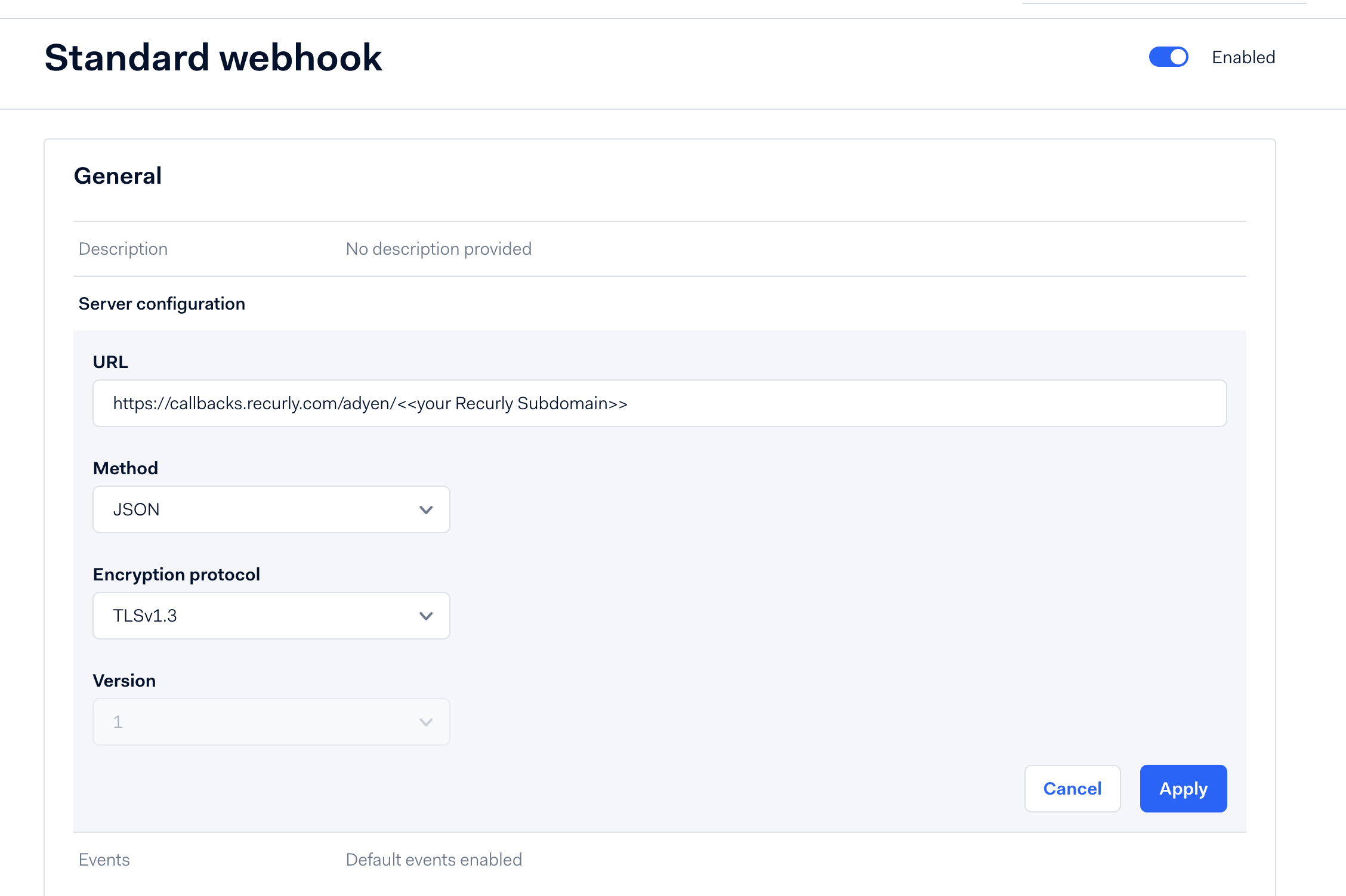

- Under "Server configuration," locate and click on the pencil icon. In the field provided, enter the URL

https://callbacks.recurly.com/adyen/<MERCHANT_SUBDOMAIN>, replacing "<MERCHANT_SUBDOMAIN>" with your Recurly site's actual subdomain. Once done, click on the "Apply" button.

- Add these 4 webhook types: in addition to any payment method specific events noted below Direct-Debit Pending, Generic Pending, Recurring Token Lifecycle events, and Standard webhook.

- Double-check that you have enabled the following event codes:

- RECURRING_CONTRACT- Required for tokenized payment methods to function properly.

- REPORT_AVAILABLE- Required for notifying when Adyen reports for various details are available such as settlement reports for Revenue Recognition.

- EXPIRE - Required for proper Auth and Capture behavior. Ensures proper report syncing from Adyen when pending authorizations expire prior to capture.

- CAPTURE_FAILED - Required to ensure proper transaction handling in general, especially when Auth and Capture are in use.

- OFFER_CLOSED -- Required when using the iDeal payment method.

- Ideal details -- Webhook information required when using the iDeal payment method. You can learn more on Adyen's website here.

- recurring.token.updated - Required when using Adyen gateway tokens to ensure Recurly receives timely meta-data updates on Adyen tokens when an update occurs outside of Recurly.

- Adyen Documentation lists two places -- please ensure both are handled, or the webhook may not be sent.

- Double-check that you have enabled the following event codes:

Note: If your site is hosted in Recurly's European Union (EU) data centers, use callbacks.eu.recurly.com in place of callbacks.recurly.com.

- Ensure the "Enabled" toggle is set as shown:

- Click “Save changes” at the bottom of the page.

Adyen additional data configuration

Activation of response fields via API

To enable card data showing up when a token is received via webhook, you'll want to enable response fields from Adyen.

Navigate to Developers→Additional Data in Adyen to enable these features. Once a token is received, we'll receive extra data from Adyen to populate card brand meta-data like the BIN, Last 4 of the Card, and other details. See below for relevant fields:

- Card bin

- Card Summary

- Expiry date

Activation of "Network Transaction Reference" and recurring details

To successfully process MIT (Merchant-Initiated Transactions) across all payment methods, including and not limited to Google Pay, Apple Pay, and cards, you must activate "Network transaction reference" in your Adyen Merchant Account settings. Additionally, for payment methods that require tokenization, enabling Recurring Details is also essential. This can be done in the same settings area in Adyen.

Navigate to Developers→Additional Data in Adyen to enable these features. Once activated, Adyen will generate a unique NTID and reusable token (if applicable) for direct integrations as related to subscriptions; however, this ID will not be visible in Recurly.

Adding Adyen to your Recurly site

- Add the Adyen gateway: Go to Configuration → Payment Gateways → Add New Gateway in your Recurly Admin.

- Enter your Adyen credentials: Provide the username, password, and merchant account details from your Adyen configuration.

- Set the custom endpoint (recommended): Only include the specific portion of the endpoint provided by Adyen, rather than the entire URL. While testing, you can use any placeholder, but update it for production.

- Select "Zero Dollar Authorization" for all card types.

- Save your configurations.

Note: Enabling Network Transaction Reference in Adyen is required for successful MIT exemptions and payment processing across all methods—including (but not limited to) Google Pay, Apple Pay, and cards. If this setting isn’t enabled, transactions may fail even if your other Adyen settings are correct.

Special considerations

Currencies

While ISK and CLP are technically zero decimal currencies (meaning they cannot have partial amounts in cents), Adyen does not have plans to update their logic around these currencies. In order to support these currencies, Recurly will be taking the amount sent in the V3 API and adding the necessary '00' decimal places when sending these transactions to Adyen. It is important to not do this in your own integration to avoid overcharging your customers.

Examples:

If the Amount value is sent in as '23', Recurly will send '2300' to Adyen. Ensure your intent is to charge 23 ISK. If a Plan amount is set to 23.00, we will also send the amount to Adyen as 2300 instead of just '23'.

Special Address Considerations

Though Recurly supports sending shipping addresses to Adyen, the gateway requires the full and complete address in order to avoid errors. Recurly will not send partial addresses to Adyen as a result. If you are attempting to utilize reporting or fraud services with Adyen and want to use shipping address information in those settings, you must ensure that the full and complete address is set within a customer's shipping address information. This includes the street address, city, state, country, and postal code.

If one or more of these fields is absent, Recurly will omit the entire shipping address.

Payment Method Specifics

Adyen Direct Debit

Adyen ACH

Recurly provides an integrated solution for ACH transactions through Adyen. Delve into the nuances of ACH payments by visiting our dedicated ACH Bank Payments documentation.

Adyen configuration

To integrate the ACH gateway, initiate the 'Adyen ACH' gateway on the "Add Payment Gateway" page.

Moreover, ensure these specific configurations are correctly set to effectively process ACH transactions:

- Set up the "report credentials". A step-by-step guide is available here.

- Actively subscribe to the Payment Accounting Report. A detailed process can be found here.

- Within Adyen, adjust settings to "immediate capture" for transactions.

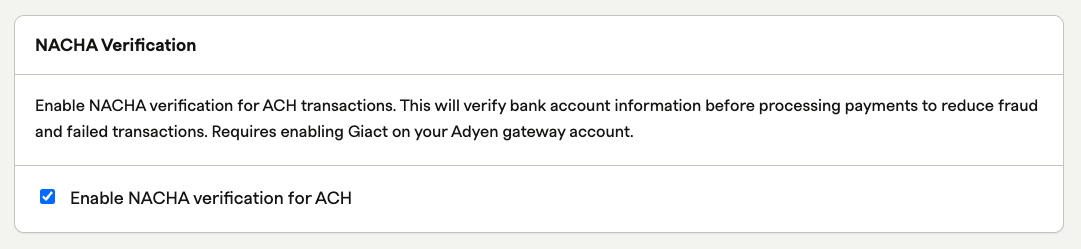

- Within Adyen, ensure you have enabled GIACT for NACHA Verification, and then enable within your Adyen configuration on Recurly.

Note: First/Last name on Checks should not be sent as dashes ( - - ) as this will cause immediate declines.

BACS

Bankers' Automated Clearing Services (BACS) Direct Debit is a widely used payment method in the United Kingdom. BACS payments support one-time and recurring transactions, however due to chargeback and late failure risks, along with the asynchronous nature of Direct Debit payments, we do not recommend using this payment method for one-time charges where physical product is being shipped.

BACS on Adyen runs specifically on Adyen gateway tokens, so Recurly does not have access to the underlying payment details. That said, this payment method still allows one-time and recurring charges to occur via Recurly.js and APIs. Creating a BACS Adyen gateway token is only possible via Recurly.js.

BACS Compliance

When using Recurly.js, you are responsible for obtaining consent and displaying appropriate regulatory information to the consumer on your website. The consumer should be aware of the amount, due date of future charges, frequency, and your Merchant business name when signing up for subscriptions.

Additionally, it would be a good idea to note that Adyen's name will appear on bank statements as "ADYEN RE [Merchant Name]'.

SEPA

Single Euro Payments Area (SEPA) Direct Debit stands as a predominant payment mode across the European Union (EU). SEPA is instrumental for merchants aiming to expand their market reach within the EU. This method facilitates one-time or recurring payments in Euros by leveraging the customer's name and bank account number (IBAN format).

As stipulated by the SEPA Direct Debit rulebook, it's imperative for merchants to notify customers each time an account debit is made. To ensure seamless communication, Recurly automatically dispatches an email to the customer. Further details can be accessed here.

Recurly supports automated retries for SEPA payments on Adyen. Learn more about SEPA Retries by visiting our documentation on the feature.

Direct Debit Recurly configuration

In your Recurly platform:

- Integrate Adyen as your gateway.

- Select the BACS checkbox under APMs in Adyen.

- Enable the EUR currency for SEPA and the GBP currency for BACS. Find out more about currency addition here.

Adyen SEPA and BACS configuration

Within your Adyen platform:

- Activate SEPA and/or BACS, depending on your needs.

- Ensure the EUR currency is available for SEPA transactions.

- Ensure the GPB currency is available for BACS transactions.

- Enable RECURRING_CONTRACT webhooks. A guide is available here.

Dual badge card support

On the Adyen platform, Recurly supports the card types of Cartes Bancaires, a card brand offered to French customers, Dankort which is available only to Danish customers (DKK currency), and Bancontact, a brand offered in Belgium. These types of cards are known as "dual-badged" meaning the customer has a preference of which network they process their transactions and subscriptions with. Customers can select the major network (Visa or MasterCard), or the regional network (Cartes Bancaires, Dankort, or Bancontact) when processing a transaction.

Dual Badge Compliance has two factors: choice and a non-distinction policy between credit and debit. Customers must be given a choice between Visa or the dual-badged option, and be given the option to enter their card into a single field labeled 'Card', whether the card is debit or credit. If you are using Recurly.js elements, this is available and built into elements for you. If you are building your own UI, keep these regulations in mind.

To enable Cartes Bancaires, Dankort, or Bancontact support on your Adyen gateway, ensure you follow the below steps:

- Within the Adyen gateway settings, ensure Cartes Bancaires, Dankort, and/or Bancontact are checked as a card payment method(s) you wish to accept.

- Integrate to Recurly.js using either the cardElement or cardNumberElement parameters. See Recurly.js documentation and our Dual/CoBadged guide for instructions on enabling card brand network preference within your implementation.

- In the case of Bancontact, ensure that SEPA is also enabled as Bancontact transactions will be converted to SEPA payments for recurring purposes.

- Fun facts:

- Bancontact cards do not have or require CVV codes.

- Bancontact cards will always require 3D-Secure. Ensure this is enabled in your Adyen account and Recurly integrations as appropriate.

- Bancontact does not support separate auth and capture.

- Fun facts:

- In the case of Dankort, ensure the DKK currency is enabled on your Adyen and Recurly sites as Dankort is only accepted with this currency.

The customer experience will be: A consumer will enter their card into the card field and if their card offers a choice, they should be presented with the options available to them as applicable to their card. They can select their network preference, and continue with their purchase or subscription sign up.

The same choice will be available when updating a billing info or changing billing information to a different dual-badged card. Cards stored in Recurly will retain that choice for subscription processing.

Notes:

- Cartes Bancaires cards experience less declines when transactions are submitted with the cardholder's billing address. Ensure you are capturing your customers' billing address if they're using a Cartes Bancaires card within your solution.

- Bancontact acceptance requires SEPA acceptance as well (see below). Please ensure you have SEPA enabled at Adyen and Recurly in order to take full advantage of Bancontact payments. For information on enabling SEPA with Adyen, please see our SEPA setup instructions below.

- Dankort acceptance requires the DKK currency to be enabled at Recurly and Adyen.

Adyen Cash App Pay

Cash App Pay is a digital wallet in the U.S. that allows users to make purchases using their Cash App balance, or linked credit card, debit card, or bank account. Cash App consumers will be able to choose 'Cash App Pay' during checkout, scan a QR code, and authorize the payment through the Cash App application on their phone.

Cash App through Adyen is only supportive of US / USD transactions.

Cash App requires Adyen's RECURRING_CONTRACT webhooks. Please refer to configuration setup steps below or Adyen's documentation for more details on webhook setup.

Recurly Configuration

In your Recurly platform:

- Integrate Adyen as your gateway using Recurly.js Alternative Payment Methods. You can find this information in Recurly Developer Hub.

- Enable the USD currency. Find out more about currency addition here.

- Check 'Cash App Pay' in your Adyen Payment Gateway settings within your Recurly site under 'Alternative Payment Methods'.

Adyen configuration

Within your Adyen platform:

- Activate Cash App Pay.

- Ensure the USD currency is available.

- Ensure you have enabled all applicable webhooks. See required Adyen Webhooks Configuration on this page.

Adyen SEPA

See 'Adyen Direct Debit→SEPA'.

Adyen iDeal

iDEAL is a widely embraced banking payment option in the Netherlands, representing a significant portion of the region's online transactions. During a transaction using iDEAL on Recurly’s checkout, customers will choose their respective banks from an accessible list of iDEAL-affiliated banks. Subsequently, they will be redirected to a unified interface to select their bank (as of April 1st 2025).

It's important to note that the inaugural payment for a subscription employs iDEAL, while subsequent payments utilize SEPA Direct Debit (owing to iDEAL's non-support for recurring payments). It's advisable to clearly communicate to customers that post the initial iDEAL transaction, recurring payments will be managed through SEPA Direct Debit.

Recurly configuration

- Integrate Adyen as the gateway.

- Activate SEPA for periodic payments.

- Ensure the EUR currency is in operation.

- Delve into the Recurly.js development guide here.

Adyen configuration

- Activate SEPA for subsequent payments.

- Ensure the EUR currency is functional.

- Ensure you have enabled all applicable webhooks. See required Adyen Webhooks Configuration on this page.

- Incorporate “Ideal details” webhooks. Steps can be found here.

Restrictions and guidelines

- Due to inherent iDEAL constraints, free trials via iDEAL are non-permissible. For free trials, Recurly suggests opting for SEPA Direct Debit.

- iDEAL cannot be used for subscriptions with a deferred commencement date.

- Chargeback management isn't feasible with iDEAL.

- Recurly's Checkout and Hosted Payment Pages do not support iDEAL.

- For a comprehensive list of limitations, refer here.

Adyen Sofort (Klarna Debit Risk)

RestrictionOnly merchants who have an existing Sofort/Klarna Debit Risk account with Adyen may use this payment method. New signups are not available with the gateway.

Sofort Klarna Debit Risk) stands out as a preferred online banking payment mechanism in countries like Germany, Austria, Switzerland, and Belgium. This payment method is compatible with EUR, CHF, and GBP currencies.

To transact with Sofort (Klarna Debit Risk), customers will choose their country, provide their bank details, and finalize the payment after receiving a confirmation from their bank.

For recurring transactions, Sofort (Klarna Debit Risk) isn't viable, and SEPA is utilized instead.

Recurly configuration

- Initiate the Adyen Gateway.

- Activate SEPA for subsequent payments.

- Ensure the EUR currency is operational.

- The Recurly.js developer guide can be accessed here.

Adyen configuration

- Ensure the relevant currencies are active.

- Integrate the OFFER CLOSED event within the Standard webhook. Guidance is available here.

Restrictions and guidelines

- Sofort is being phased out by Klarna and no new merchant accounts can be acquired at this time. Sofort will be replaced by Klarna Debit Risk behind the scenes at Adyen on September 30th. Merchants will see branding and UI changes after that time period. Adyen has stated no major technical changes are necessary, but that it is important to pass along the Country Code for proper routing. Please update your Recurly.js implementations if you are not passing this field.

- Inherent limitations in Sofort (Klarna Debit Risk) restrict its use for free trials. For such offers, Recurly suggests SEPA Direct Debit.

- Sofort (Klarna Debit Risk) isn't compatible with subscriptions that have a deferred start.

- Sofort (Klarna Debit Risk) transactions cannot be chargeback managed.

- Recurly’s Hosted Payment Pages don't support Sofort (Klarna Debit Risk).

- For a holistic understanding of the limitations, refer here.

- SOFORT is also known as Klarna Debit Risk. This payment method is not the BNPL/Buy Now Pay Later flavor of Klarna.

Adyen Boleto

Boleto Bancário, commonly known as Boleto, a popular payment method in Brazil, is usually utilized by individuals without access to bank accounts. This payment method is compatible with BRL

This guide outlines the steps to integrate Boleto with your payment systems through Adyen and Recurly, focusing on initial setup, checkout integration, and handling recurring payments.

Recurly configuration

- Activate Brazilian Real (BRL) currency.

- Integrate Adyen as a gateway.

- Leverage Recurly JS to integrate the Boleto payment option directly into your checkout page.

- Establish a Boleto-specific email template for recurring payments. This template should be designed to notify shoppers about upcoming payments and provide them with a direct link to download the Boleto invoice.

Adyen configuration

- Contact your Adyen representative to ensure your account is aligned with an entity recognized in Brazil.

- Enable the Boleto payment method within your Adyen account settings.

- Make sure that Brazilian Real (BRL) is activated in your Adyen account.

Restrictions and guidelines

Due to Boleto's nature, which does not support direct recurring transactions, a specialized process is implemented to handle subscription renewals:

- For each renewal, Recurly automatically generates a new recurring invoice. This invoice initially appears as "Past Due" to account for the Boleto payment processing time.

- Recurly then communicates with the payment gateway to issue a new Boleto invoice for the renewal amount.

- Utilize the previously configured Boleto email template to inform customers about the new invoice, providing them with a link to download the Boleto.

- Once the customer pays the Boleto invoice, the status of the invoice in Recurly is updated to "Paid," completing the transaction cycle.

- Consider using Boleto as a method to increase customer balance, offering flexibility in payment options and enhancing customer satisfaction.

Additional configuration

For Adyen to send essential details to Recurly, set up specific features based on your payment method.

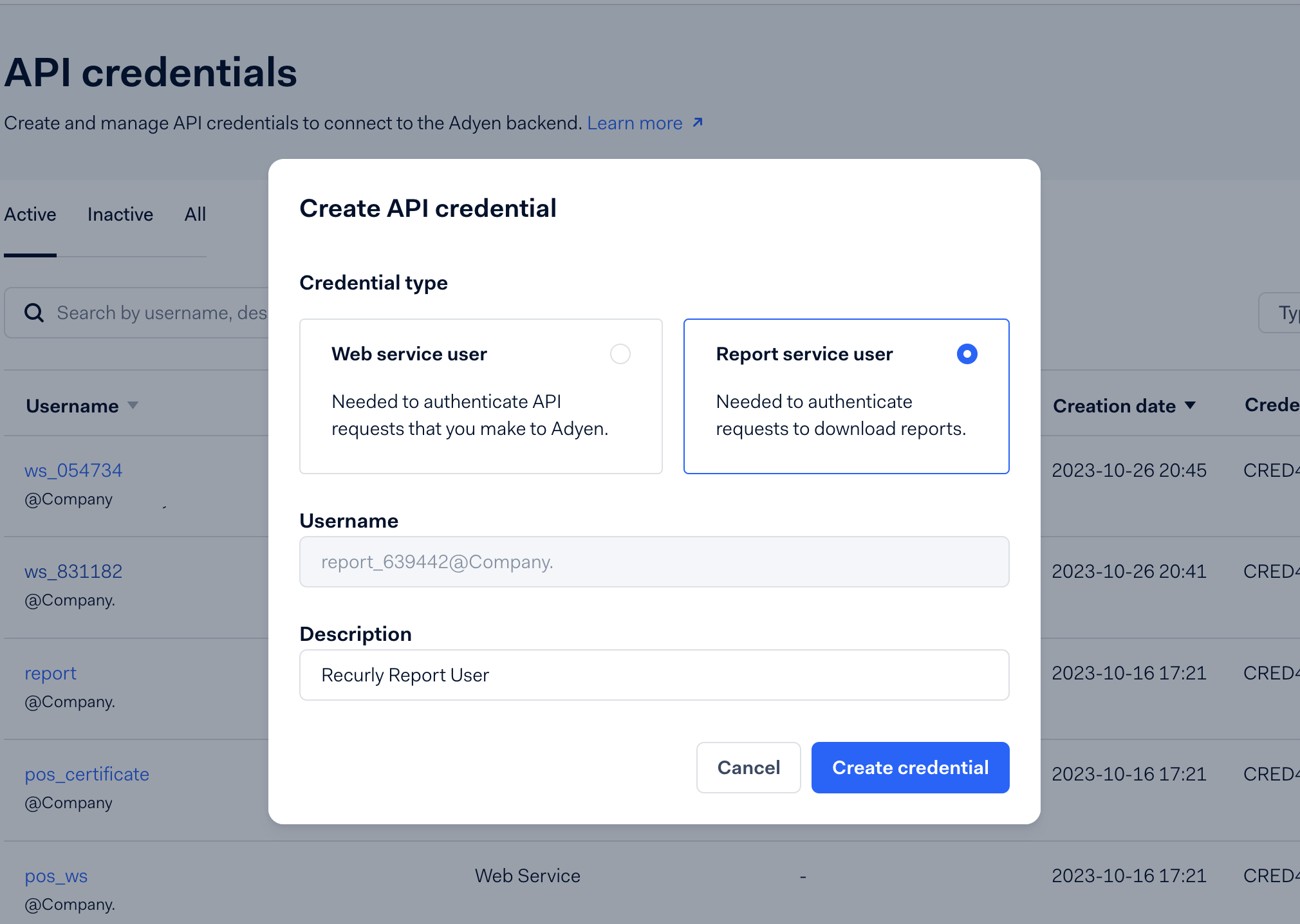

Setting up "Report Credentials" for ACH and SEPA:

- Log into Adyen, choose "Developers"→"API credentials".

- If there's no "reporting user", create one. Designate it as "Report service user".

- Save the password generated under “Server Settings” >> “Authentication” >> “Basic auth” prior to saving changes, or you will need to regenerate the password.

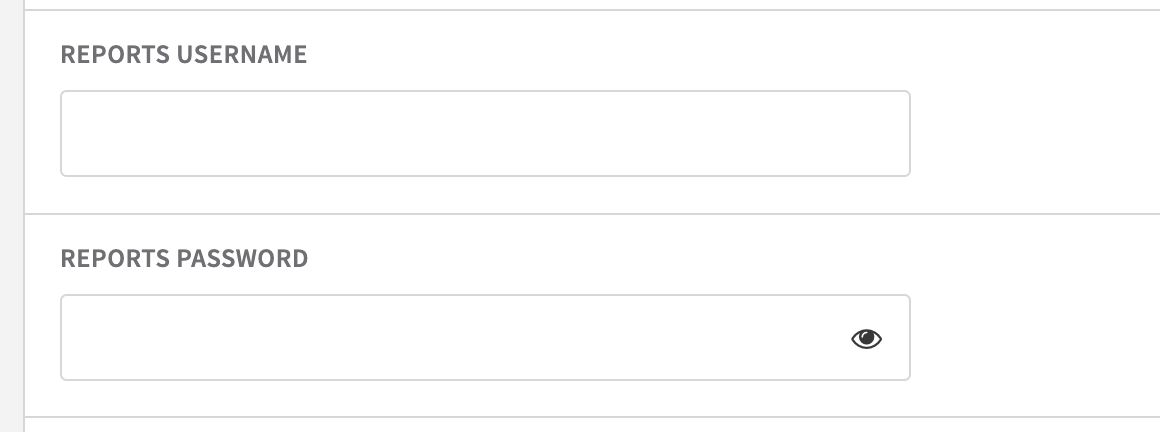

- Enter the credentials in Recurly under "REPORTS USERNAME" and "REPORTS PASSWORD".

Subscribing to the payment accounting report for ACH

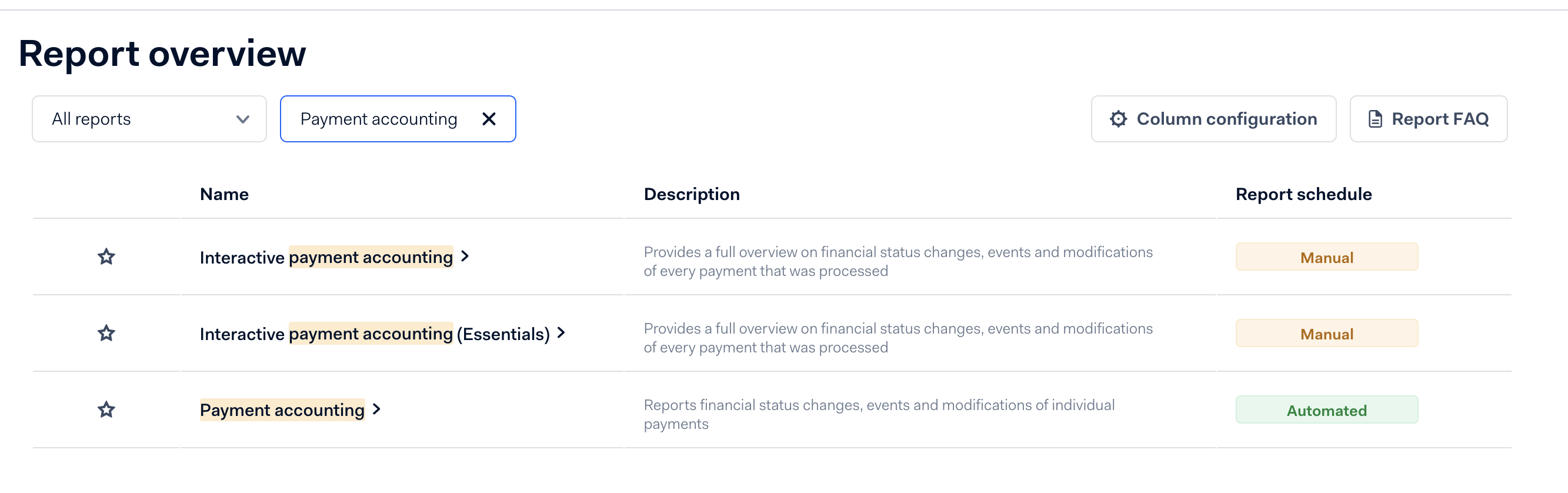

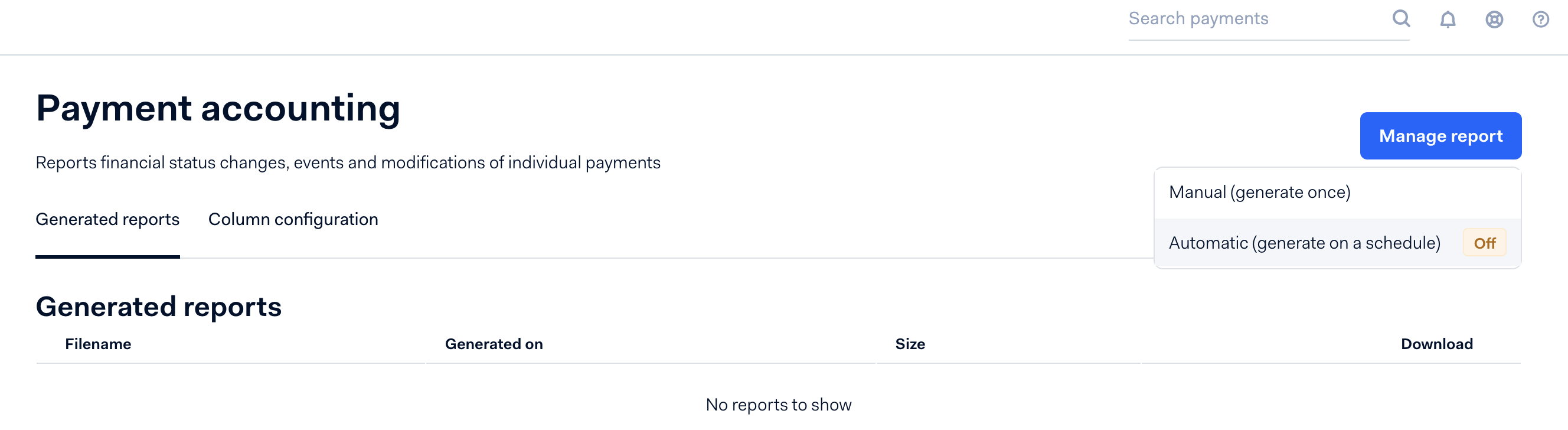

- In Adyen, go to Reports. In the "Finance" section, click on “Payment Accounting" and then “Manage report”. You will see “Automatic (generate on a schedule)” set to Off if you have never enabled it.

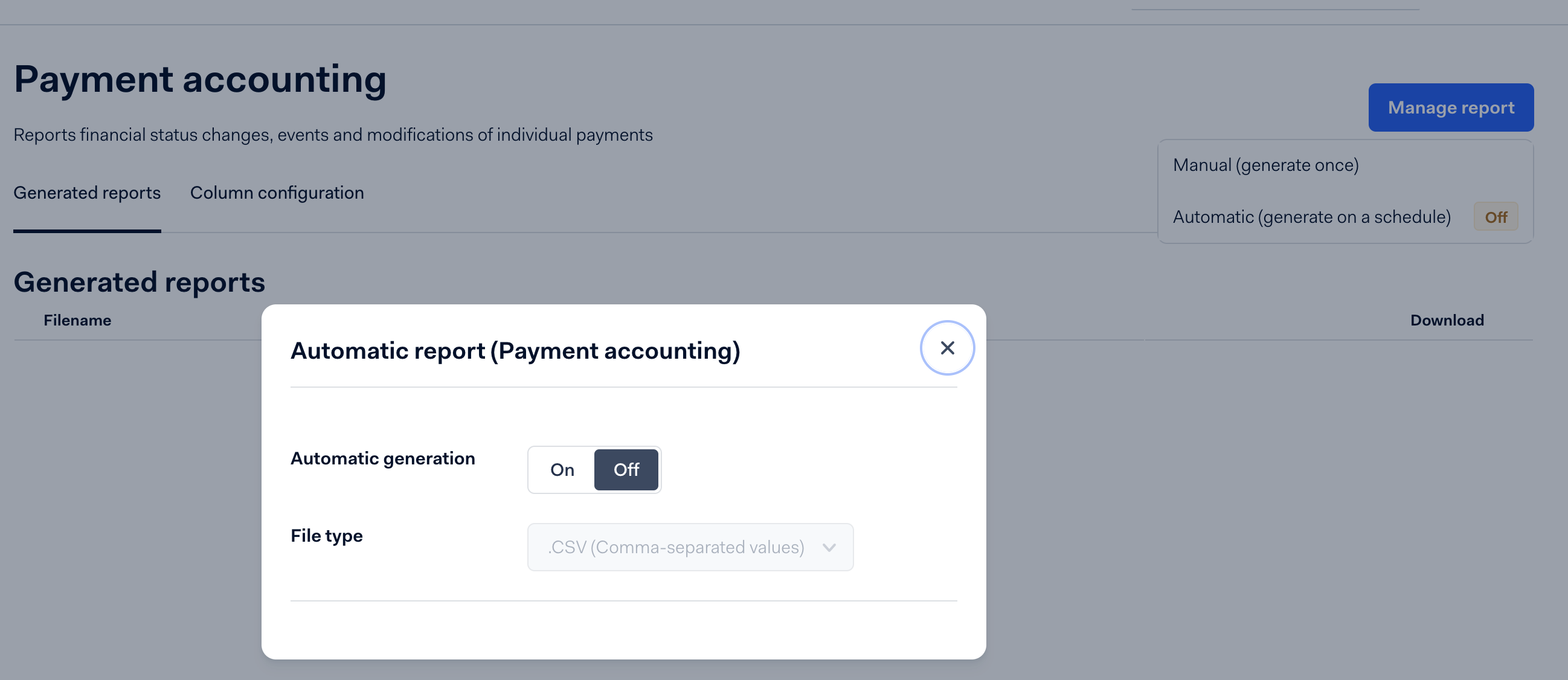

- Select "Automatic" and toggle automatic generation to “On” and set the file type as CSV. Click the ‘X’ to close the dialogue box.

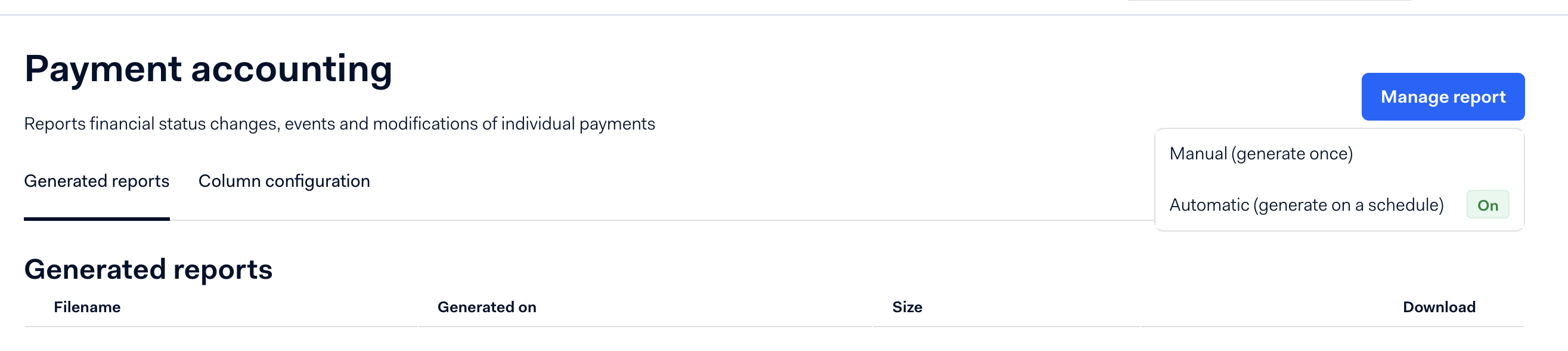

- If you click “Manage report” again, you can confirm that the report is now automatically generated.

Configuring Adyen notifications for Recurly

-

In Adyen, go to Developers→Webhooks.

-

Click “+ Webhook” using the upper-right blue button.

- Add these 4 webhook types: Direct-Debit Pending, Generic Pending, Recurring Token Lifecycle events, and Standard webhook.

- Double-check that you have enabled the following event codes:

RECURRING_CONTRACT- Required for tokenized payment methods to function properly.REPORT_AVAILABLE- Required for notifying when Adyen reports for various details are available such as settlement reports for Revenue Recognition.EXPIRE- Required for proper Auth and Capture behavior. Ensures proper report syncing from Adyen when pending authorizations expire prior to capture.CAPTURE_FAILED- Required to ensure proper transaction handling in general, especially when Auth and Capture are in use.recurring.token.updated- Required when using Adyen gateway tokens to ensure Recurly receives timely meta-data updates on Adyen tokens when an update occurs outside of Recurly.

- Adyen Documentation lists two places -- please ensure both are handled, or the webhook may not be sent.

- Double-check that you have enabled the following event codes:

- Ensure you are entering the correct callback URL in the Server configuration of each webhook. Click “Apply” and then “Save changes” for each webhook you activate.

These payment methods are pivotal for merchants aiming to expand in Europe and other relevant regions. With Recurly’s integration with Adyen, businesses can offer their customers a plethora of payment options, facilitating smoother transactions and increasing conversion rates. For any queries, connect with our support or explore our expansive knowledge base.

Gateway feature support

Adyen real time account updater

Adyen Real Time Account Updater (RTAU) updates card details and expiration dates in real time during a transaction. This can improve authorisation rates and help keep renewals up to date when a customer’s card details change.

Adyen returns Payment Card Industry (PCI) card data encrypted to Recurly. To process those encrypted updates, you must generate an RSA key in Recurly and provide the public key to Adyen for configuration.

Before you start, confirm with Adyen that RTAU is enabled for your account and that you’ve completed any required agreements.

Ensure eligibility

- You’re using raw cards with Adyen as your primary gateway through a supported Recurly API or Recurly.js (not Adyen Web Components)

- You’re not using Adyen gateway tokens or network tokens

- You’re not using Adyen third-party checkout or components through Recurly.js

Recurly configuration (RSA key)

-

Navigate to Configuration → Payment Gateways

-

On your Adyen gateway, select Options, then select Manage Keys

-

If you haven’t created a key yet, select Add a Real Time Account Updater Key

- If you have multiple Adyen gateway instances that point to the same Adyen account, you can share an RSA key instead of creating a new one

-

Select Generate New Key, or select Use Existing Key to reuse a key across multiple Adyen instances

-

Select Add Key

Adyen configuration (RSA key and RTAU enablement)

You can’t configure the RSA key in the Adyen dashboard directly. Copy the public key from Recurly and provide it to Adyen through a support ticket. Send the request to Adyen support, and include the public key exactly as shown in Recurly.

Once Adyen applies the public RSA key, RTAU starts working automatically.

How Adyen RTAU works with Recurly Account Updater

If you enable both services, card updates that come through Adyen RTAU won’t be sent to Recurly Account Updater. Adyen supports Visa, Mastercard, and regional American Express only. If you want to keep receiving Discover and additional American Express updates, keep Recurly Account Updater enabled alongside Adyen RTAU.

Adyen RTAU updates may include:

-

Card PAN changes: Recurly decrypts the PAN (when an RSA key is set up) and updates the billing information on the account

-

Note: Because RTAU runs in real time, if Adyen returns a full card update, Adyen uses the updated card to complete the transaction, and Recurly saves the updated card for future use

-

Example:

- Visa ending in 1234 is sent for authorisation

- Adyen attempts Visa 1234, and it declines

- Adyen requests an update in real time and receives Visa 4567

- Adyen attempts Visa 4567, and it approves

- Adyen returns the approval and encrypted Visa 4567 for future use

-

-

Card expiration date changes: Recurly updates the expiration date on file

-

Closed account notices: Recurly invalidates the billing information for the account

-

Contact customer notices: Recurly doesn’t update billing information, but logs the response in Account Activities when a transaction declines

Disable RSA keys for Adyen RTAU

To stop using Adyen RTAU, revoke the RSA key for each Adyen gateway where it’s enabled:

- Navigate to Configuration → Payment Gateways

- On the Adyen gateway, select Options → Manage Keys

- Revoke the RSA key

You should also contact Adyen to disable RTAU on their side. If Recurly Account Updater is enabled, it resumes processing updates for supported card brands after RTAU is disabled.

Adyen network tokens

If Adyen is enabled to create network tokens for your merchant account (cards only), Recurly surfaces whether a network token was used on each transaction.

You can find this in:

- Transaction details in the Recurly Admin UI

- Gateway parameter responses through the API

Recurly displays this as a boolean field called Third Party Network Token Used:

Falsemeans a raw primary account number (PAN) or card data was usedTruemeans a network token was used

If network tokens aren’t enabled in your Adyen account, this value will always be False.

If you have questions about why a network token was or wasn’t used, contact Adyen support or your Adyen representative. Token usage is determined by Adyen, not by Recurly.

Important: Adyen uses network tokenisation only for tokenised payment methods. Recurly supports tokenising cards only when you use Adyen Web Components through Recurly.js.

Revenue Protect and Protect Premium

If you use Revenue Protect or Protect Premium with Adyen, Recurly supports sending the data Adyen needs to evaluate risk and apply your rules.

Protect Premium support

If you have a paid subscription to Adyen Protect Premium, you can create custom risk profiles in Adyen and pass the profile ID to Recurly when you create subscriptions or one-time charges through the V3 API.

- V3 field:

billing_info.adyen_risk_profile_reference_id - Adyen reference: Create Risk Profiles

Data Recurly sends to support risk decisions

-

Billing and shipping address data

- Review Shipping Data on Adyen

- For setup guidance, see Shipping addresses

-

Shipping method and amount

- Recurly sends the invoice shipping amount and the shipping method you set in Recurly

- Recurly sends the shipping method Name value to Adyen

- See Shipping methods

-

Browser information

- Sent when the shopper is routed through 3D Secure (3DS)

- Revenue Protect can evaluate browser-based rules at the gateway

-

Shopper data

- Email address, phone number, name, IP address (when the shopper is in session), and shopper reference

- If shopper details aren’t present on the account, they won’t be sent

- Shopper IP addresses aren’t sent to Adyen on renewals

-

Acquisition date

- Send account acquisition dates using

acquisition.acquired_atin the V3 API - You can backfill acquisition dates by updating existing accounts

- See the V3 acquired_at field documentation

- Send account acquisition dates using

Limitations

-

Review rules aren’t supported for Adyen Protect (new risk engine) when you use Purchase transactions

- If you need Review, use an Authorise and Capture flow where your system controls capture

- When using purchases, use only Allow, Block, or Check for 3DS actions

Important notes

- Follow customer notification requirements (for example, SEPA renewal notices)

- Recurly can export billing information from Adyen for SEPA subscription renewals

- Recurly sends purchase transactions to Adyen with a capture flag, overriding your Adyen settings

How asynchronous payments work

- After a successful purchase, the subscription is marked as "active", but the invoice and transaction remain "processing" until Adyen confirms payment approval

- Recurly sends a "processing payment" webhook to configured endpoints and a "payment processing" email to customers (if enabled)

- Adyen’s initial return token after billing is "unverified" while the bank confirms the payment

- Within 48 hours, the token becomes "verified", and additional transactions can proceed

- Recurly updates the transaction and invoice status based on Adyen feedback, and sends the relevant webhooks and emails

- Dunning and retries: Asynchronous payments need special handling in dunning. See the PayPal eChecks guidance in PayPal payments

Asynchronous payment methods

Adyen supports asynchronous payment methods such as SEPA and Boleto. Because these methods can take several days to settle, payment processing behaves differently in Recurly.

For customer billing information updates

For billing information updates, direct customers to Recurly hosted pages. Recurly charges the new billing information a small amount. After Adyen approves the purchase, Recurly automatically issues a refund.

IP address allowlist

In some scenarios, Adyen may use additional IP addresses. These must be allowlisted in Recurly. Before you move to production, contact Recurly Support for help.

API integration with Recurly

In a standard Recurly.js flow, Recurly handles payment authorisation. The customer enters billing details first. After authorisation, you create the subscription and process the charge.

Troubleshooting

Q: A tokenised payment method I’m using (all non-card payments) isn’t allowing conversions, or subscriptions are failing. What can I do?

A: Confirm you’ve enabled the required webhooks. RECURRING_CONTRACT webhooks are critical for these payment methods. See the webhook configuration section above.

Q: My customer tried to check out and got a decline from Adyen. What happened? A: Start with the decline code shown in the Recurly Admin UI for the transaction. If the decline is related to 3DS, confirm 3DS is enabled and configured in both Adyen and your Recurly.js implementation. If 3DS is already enabled, the customer may not have completed the 3DS challenge successfully, and the decline is expected.

Updated 6 days ago